Public Safety Canada Quarterly Financial Report

For the quarter ended December 31, 2016

Table of Contents

- 1.0 Introduction

- 2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

- 3.0 Risks and Uncertainty

- 4.0 Significant Changes in Relation to Operations, Programs and Personnel

- 5.0 Approval by Senior Officials

- 6.0 Statement of Authorities (unaudited)

- 7.0 Departmental budgetary expenditures by Standard Object (unaudited)

1.0 Introduction

This quarterly financial report for the period ending December 31, 2016 has been prepared by management as required by section 65.1 of the Financial Administration Act, in the form and manner prescribed by Treasury Board. The report should be read in conjunction with the Main Estimates and the Supplementary Estimates, as well as Growing the Middle Class (Budget 2016).

This quarterly financial report has not been subject to an external audit or review. However, it has been reviewed by the Departmental Audit Committee prior to approval by senior officials.

Information on the mandate, roles, responsibilities and programs of Public Safety Canada can be found in the 2016-17 Report on Plans and Priorities and the 2016-17 Main Estimates.

1.1 Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities table includes the Department's spending authorities granted by Parliament, or received from Treasury Board Central Votes, and those used by the Department consistent with the Main Estimates and the Supplementary Estimates (B) for the 2016-17 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet the information needs concerning the use of spending authorities.

The authority of Parliament is required before funds can be spent by the Government. Approvals are given in the form of annually approved limits through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

Public Safety Canada uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis, as do the expenditures presented in this report.

2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

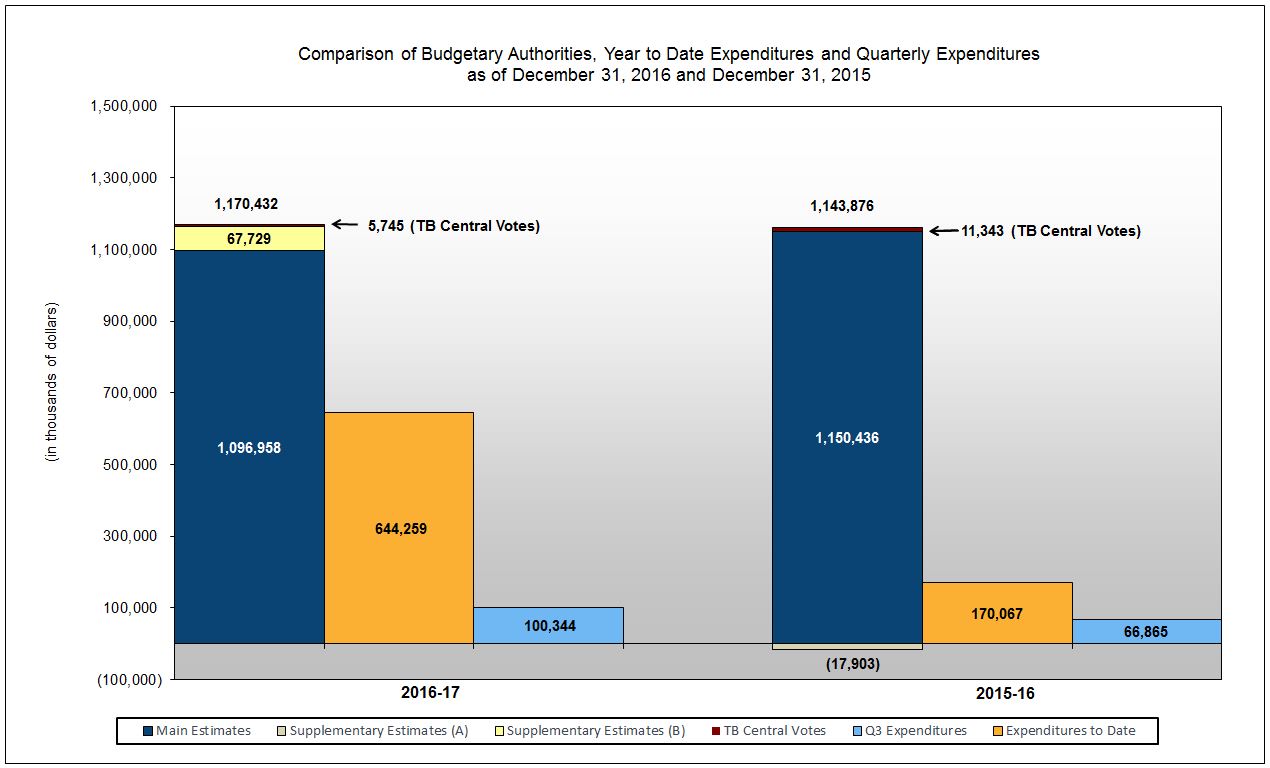

The following graph provides a comparison of the net budgetary authorities and expenditures as of December 31, 2016 and December 31, 2015 for the Department's combined:

- Vote 1: Operating Expenditures;

- Vote 5: Grants and Contributions;

- Statutory Votes:

- Employee Benefit Plans; and

- Minister's Salary and Car Allowance.

Image description

Starting from the left hand side, the “first” column in the graph indicates that the Department authorities are at $1,170.4 million for fiscal year 2016-17. The year-to-date expenditures of $644.3 million reported at the end of the second quarter of the 2016-17 fiscal year are shown under the “second” column. The expenditures of $100.3 million for the period ended December 31, 2016 (i.e. third quarter) are presented under the “third” column. The fourth column in the graph depicts the 2015-16 authorities which were at $1,143.9 million at the end of December 2015. The 2015-16 year-to-date expenditures of $170.1 million are shown under the “fifth” column. The Departments’ actual expenditures incurred in the third quarter of 2015-16 were $66.9 million and are shown under the “sixth” column of the graph.

Note: The 2015-16 Supplementary Estimates "A" (SEA) decreased net funding by $17.9M as a result of a transfer of $41.5M to the Royal Canadian Mounted Police for the First Nations Community Policing Service, offset by increases of $23.6M for other items included in SEA.

2.1 Significant Changes to Authorities

For the period ending December 31, 2016, the authorities provided to the Department include Main Estimates, Supplementary Estimates (B) and TB Central Vote transfers. The 2015-16 authorities for the same period included Main Estimates, Supplementary Estimates (A) and TB Central Vote transfers. The Statement of Authorities table presents a net increase of $26.6 million (2.3 percent) compared to those of the same period of the previous year (from $1,143.9 million to $1,170.4 million).

Operating Expenditures authorities have increased by $9.7 million (7.7 percent) mainly due to:

- An increase of $8.4 million to advance Phase II of Canada's Cyber Security Strategy, which will introduce actions to secure cyber systems outside of the Government of Canada;

- An increase of $1.1 million for the creation of the office for community outreach and countering radicalization to violence announced in Budget 2016;

- A decrease of $1.0 million related to the sunsetting of the Kanishka Project Research Initiative, which supported research on pressing questions for Canada on terrorism and counter-terrorism;

- An increase of $0.8 million for funding the National Disaster Mitigation Program announced in Budget 2014, which aims at reducing the impacts of natural disasters on Canadians; and

- A net increase of $0.4 million for other initiatives of lesser value.

Grants and Contributions (G&C) authorities have increased by $15.7 million (1.6 percent) mainly due to:

- A decrease of $158.6 million for non-discretionary requirements to address existing and future obligations under the Disaster Financial Assistance Arrangements program;

- An increase of $104.5 million for matching domestic charitable donations to the Canadian Red Cross in support of wildfire relief efforts in Fort McMurray, Alberta and surrounding areas in 2016;

- An increase of $38.3 million for financial assistance to the Province of Quebec for decontamination costs following the train derailment and explosion in Lac-Mégantic, Quebec in 2013;

- An increase of $21.5 million for the National Disaster Mitigation Program, which aims at reducing the impacts of natural disasters on Canadians;

- An increase of $4.2 million for the transfer of control and supervision of the National Search and Rescue Secretariat (NSS) from the Department of National Defence (DND), offset with transfers to and from other organizations for investments in search and rescue prevention and coordination initiatives across Canada;

- An increase of $3.1 million for the creation of the Heavy Urban Search and Rescue Program announced in Budget 2016; and

- A net increase of $2.7 million for other initiatives of lesser value.

Budgetary Statutory authorities have increased by $1.2 million (7.9 percent) in 2016-17 mostly as a result of the Employee Benefit Plan (EBP) costs associated with the change in the Department budgetary requirements for salary and EBP.

2.2 Significant Variances from Previous Year Expenditures

Year-to-Date Expenditures

For the period ending December 31, 2016, the Departmental Budgetary Expenditures by Standard Object table presents a net increase of $474.2 million (278.8 percent) in Public Safety's year-to-date (YTD) expenditures compared to the previous year (from $170.1 million to $644.3 million). The increase is mostly due to:

- Payments made under the Disaster Financial Assistance Arrangements (DFAA) program ($355.7 million), a large portion of which was dedicated to an advance payment to the Province of Alberta to assist with the recovery efforts of the Fort McMurray wildfire ($307.0 million);

- Matching domestic charitable donations to the Canadian Red Cross in support of wildfire relief efforts in Fort McMurray, Alberta and surrounding areas ($104.5 million); and

- A net increase of $14.0 million for other expenditure variances of lesser value.

Third Quarter Expenditures

Compared to the previous year, expenditures used during the quarter ended December 31, 2016, have increased by $33.5 million (50.1 percent) (from $66.9 million to $100.3 million) reflected in the Departmental Budgetary Expenditures by Standard Object table.

- Personnel expenditures have increased by $2.0 million (7.9 percent) mainly due to an increase in expenditures in regular salaries for continuing employees ($2.0 million) as a result of addressing staffing gaps and commencing new programs.

- Other operating expenditures have decreased by $2.2 million (28.6 percent) mainly due to decreases in professional and special services ($2.1 million).

- Transfer payments expenditures have increased by $33.6 million (98.7 percent) mainly due to:

- An increase of $47.7 million in payments under the Disaster Financial Assistance Arrangements (DFAA) program;

- A decrease of $17.9 million in expenditures for the First Nations Policing Program; and

- A net increase of $3.8 million for other expenditure variances of lesser value.

3.0 Risks and Uncertainty

The Department's mandate spans from public safety and security, intelligence and national security functions, social interventions for youth-at-risk, to readiness for all manner of emergencies. Public Safety is called, on behalf of the Government of Canada, to rapidly respond to emerging threats and ensure the safety and security of Canadians. The Department's ability to deliver its programs and services is subject to several risk sources, such as the rapidly changing asymmetrical threat environment, its ability to respond to natural or man-made disasters, government priorities, and government-wide or central agency initiatives. To deliver this mandate effectively, the collaboration of many departments and agencies, provincial and territorial governments, international partners, private sector and first responders is required.

Disaster Financial Assistance Arrangements

The Disaster Financial Assistance Arrangements (DFAA) contribution program presents a greater level of risk and uncertainty than other PS grants and contributions programs given that it represents a significant portion of the PS budget and that it is subject to unforeseen events. The DFAA was established in 1970 to provide a consistent and equitable mechanism for federal sharing of provincial and territorial costs for natural disaster response and recovery where such costs would place an undue burden on a provincial or territorial economy.

- There are currently 77 natural disasters for which Orders-in-Council (OiCs) have been approved, authorizing the provision of federal financial assistance under the DFAA, and for which final payments have not yet been made.

- Public Safety's total outstanding share of liability under the DFAA in regards to these 77 events is $2.0 billion at December 31, 2016, the majority of which is expected to be paid out over the next five years.

- The following are the most significant events within Public Safety's DFAA liability:

- Manitoba 2011 Spring Flood ($350 million);

- Alberta 2013 June Flood ($305 million);

- Alberta 2016 Wildfires ($168 million);

- Manitoba 2014 June Rainstorm ($160 million); and

- Saskatchewan 2011 Spring Flood ($145 million).

Phoenix Pay Modernization Project

In April 2016, Public Safety moved to the new Phoenix federal public service pay system. In transitioning to the new pay system, large backlogs and delays at the centralized Pay Centre have led to a significant increase in pay-related issues reported by employees.

To support employees at highest risk, a priority system has been implemented for triaging and escalating pay issues, to ensure that the most urgent cases are resolved as quickly as possible. Departmental working groups have been created and leveraged on an ongoing basis to discuss issues related to Phoenix and to develop solutions. Unions have also been engaged to ensure that employees' perspectives are represented.

The Department is closely monitoring pay transactions to identify and address over and under payments in a timely manner.

4.0 Significant Changes in Relation to Operations, Programs and Personnel

- On November 21, 2016, Caroline Weber was appointed Chief Financial Officer and Assistant Deputy Minister (ADM) of Corporate Management Branch.

- Jill Wherrett, will act on an interim basis as ADM, Portfolio Affairs and Communications Branch (PACB), replacing Paul MacKinnon who left Public Safety on December 9, 2016.

5.0 Approval by Senior Officials

Approved as required by the Policy on Financial Resource Management, Information and Reporting:

Malcolm Brown

Deputy Minister

Public Safety Canada

Ottawa (Canada)

Date: February 10, 2017

Caroline Weber

Chief Financial Officer and Assistant

Deputy Minister, Corporate Management Branch

Public Safety Canada

Ottawa (Canada)

Date: February 9, 2017

6.0 Statement of Authorities (unaudited)

| Total available for use for the year ending March 31, 2017 (1) |

Used during the quarter ended December 31, 2016 |

Year to date used at quarter-end |

|

|---|---|---|---|

| Vote 1 - Net Operating Expenditures | 135,541,965 | 28,663,990 | 85,217,886 |

| Vote 5 - Grants and Contributions | 1,018,667,084 | 67,677,703 | 547,039,695 |

| Employee Benefit Plans (EBP) | 16,139,909 | 3,981,772 | 11,945,316 |

| Minister's Salary and Motor Car Allowance | 83,500 | 20,875 | 55,666 |

| TOTAL AUTHORITIES | 1,170,432,458 | 100,344,340 | 644,258,563 |

| (1) Includes only authorities available for use and granted by Parliament at quarter end. | |||

| Total available for use for the year ended March 31, 2016 (1) |

Used during the quarter ended December 31, 2015 |

Year to date used at quarter-end (2) |

|

|---|---|---|---|

| Vote 1 - Net Operating Expenditures | 125,853,233 | 29,110,924 | 77,303,748 |

| Vote 5 - Grants and Contributions | 1,002,988,545 | 34,067,677 | 81,691,054 |

| Employee Benefit Plans (EBP) | 14,952,248 | 3,672,329 | 11,016,989 |

| Minister's Salary and Motor Car Allowance | 82,100 | 13,850 | 54,900 |

| TOTAL AUTHORITIES | 1,143,876,126 | 66,864,780 | 170,066,691 |

|

(1) Includes only authorities available for use and granted by Parliament at quarter end. (2) National Search and Rescue Secretariat (NSS) deemed authorities have been transferred in the third quarter of 2015-16 from the Department of National Defence. Corresponding expenditures where transferred in the fourth quarter of 2015-16. |

|||

7.0 Departmental budgetary expenditures by Standard Object (unaudited)

| Planned expenditures for the year ending March 31, 2017 (1) |

Expended during the quarter ended December 31, 2016 |

Year to date used at quarter-end |

|

|---|---|---|---|

| Expenditures: | |||

| Personnel | 109,886,861 | 27,118,122 | 81,067,384 |

| Transportation and communications | 4,087,479 | 1,010,094 | 2,201,295 |

| Information | 7,249,103 | 498,219 | 1,368,051 |

| Professional and special services | 22,364,965 | 2,689,080 | 10,628,872 |

| Rentals | 4,423,345 | 956,399 | 2,655,670 |

| Repair and maintenance | 485,944 | 101,116 | 189,264 |

| Utilities, material and supplies | 1,163,906 | 114,758 | 323,584 |

| Acquisition of land, buildings and works | 2,254,705 | - | - |

| Acquisition of machinery and equipment | 2,549,066 | 204,264 | 559,989 |

| Transfer payments | 1,018,667,084 | 67,677,703 | 547,039,695 |

| Public debt charges | - | - | - |

| Other subsidies and payments | - | 8,625 | 12,819 |

| Total gross budgetary expenditures | 1,173,132,458 | 100,378,380 | 646,046,623 |

| Less Revenues netted against expenditures: | |||

| Interdepartmental Provision of Internal Support Services | 2,700,000 | 34,040 | 1,788,060 |

| Total net budgetary expenditures | 1,170,432,458 | 100,344,340 | 644,258,563 |

| (1) Includes only planned expenditures against authorities for use and granted by Parliament at quarter end. | |||

| Planned expenditures for the year ended March 31, 2016 (1) |

Expended during the quarter ended December 31, 2015 |

Year to date used at quarter-end (2) |

|

|---|---|---|---|

| Expenditures: | |||

| Personnel | 105,345,537 | 25,142,467 | 73,622,532 |

| Transportation and communications | 3,307,433 | 919,698 | 2,068,087 |

| Information | 5,968,759 | 234,771 | 714,367 |

| Professional and special services | 18,854,465 | 4,865,194 | 9,574,149 |

| Rentals | 2,862,983 | 1,054,782 | 2,133,447 |

| Repair and maintenance | 1,356,679 | 69,270 | 190,459 |

| Utilities, material and supplies | 1,116,431 | 144,113 | 400,474 |

| Acquisition of land, buildings and works | 1,599,536 | - | - |

| Acquisition of machinery and equipment | 3,089,685 | 505,162 | 1,026,366 |

| Transfer payments | 1,002,988,545 | 34,067,677 | 81,691,054 |

| Public debt charges | - | - | - |

| Other subsidies and payments | 86,074 | 22,377 | 92,815 |

| Total gross budgetary expenditures | 1,146,576,126 | 67,025,511 | 171,513,750 |

| Less Revenues netted against expenditures: | |||

| Interdepartmental Provision of Internal Support Services | 2,700,000 | 160,731 | 1,447,059 |

| Total net budgetary expenditures | 1,143,876,126 | 66,864,780 | 170,066,691 |

|

(1) Includes only planned expenditures against authorities for use and granted by Parliament at quarter end. (2) National Search and Rescue Secretariat (NSS) deemed authorities have been transferred in the third quarter of 2015-16 from the Department of National Defence. Corresponding expenditures where transferred in fourth quarter of 2015-16. |

|||

- Date modified: