Public Safety Canada Quarterly Financial Report for the quarter ended September 30, 2022

Table of Contents

- 1.0 Introduction

- 2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

- 3.0 Risks and Uncertainty

- 4.0 Significant Changes in Relation to Operations, Programs and Personnel

- 5.0 Approval by Senior Officials

- 6.0 Statement of Authorities (unaudited)

- 7.0 Departmental budgetary expenditures by Standard Object (unaudited)

1.0 Introduction

This quarterly financial report for the period ending September 30, 2022 has been prepared by management as required by section 65.1 of the Financial Administration Act, in the form and manner prescribed by Treasury Board. The report should be read in conjunction with the Main Estimates and Supplementary Estimates (A).

This quarterly financial report has not been subject to an external audit or review. However, it has been reviewed by the Departmental Audit Committee prior to approval by the Deputy Minister.

Information on the mandate, roles, responsibilities and programs of Public Safety Canada can be found in the 2022-23 Departmental Plan and the 2022-23 Main Estimates.

1.1 Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities table includes the Department’s spending authorities granted by Parliament, or received from Treasury Board Central Votes, and those used by the Department consistent with the Main Estimates, the Supplementary Estimates (A) for the 2022‑23 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet the information needs concerning the use of spending authorities.

The authority of Parliament is required before funds can be spent by the Government. Approvals are given in the form of annually approved limits through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

Public Safety Canada uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis, as do the expenditures presented in this report.

2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

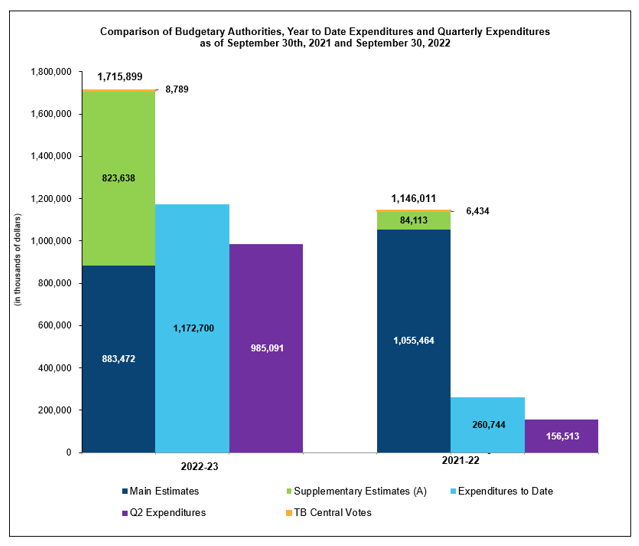

The following graph provides a comparison of the net budgetary authorities and expenditures as of September 30, 2022 and September 30, 2021 for the Department’s combined:

- Vote 1: Operating Expenditures;

- Vote 5 and Statutory: Grants and Contributions;

- Statutory Votes:

- Employee Benefit Plans; and

- Minister’s Salary and Car Allowance.

Image description

Budgetary Authorities and Expenditures Comparison

Starting from the left hand side, the “first” column in the graph indicates that the Department authorities are at $1,715.9 million for fiscal year 2022-23. The year-to-date expenditures of 1,172.7 million reported at the end of the second quarter of the 2022-23 fiscal year are shown under the “second” column. The expenditures of 985.1 million for the period ended September 30, 2022 (i.e. second quarter) are presented under the “third” column. The “fourth” column in the graph depicts the 2022-23 authorities which were at 1,146.0 million at the end of September 2021. The 2021-22 year-to-date expenditures of 260.7 million reported at the end of the second quarter of the 2021-22 fiscal year are shown under the “fifth” column. The Departments’ actual expenditures incurred in the second quarter of 2021-22 were 156.5 million and are shown under the “sixth” column of the graph.

2.1 Significant Changes to Authorities

For the period ending September 30, 2022, the authorities provided to the Department include Main Estimates, Supplementary Estimates (A) and TB Central Vote transfers. The 2021-22 authorities for the same period included the Main Estimates, Supplementary Estimates (A) and TB Central Vote transfers. The Statement of Authorities table presents a net increase of $569.9 million (49.7 percent) compared to those of the same period of the previous year (from $1,146.0 million to $1,715.9 million).

Operating Expenditures authorities have increased by $9.5 million (4.7 percent) (from $200.4 million to $209.9 million), which is primarily attributable to:

- An increase of $6.1 million for relocation and accommodations for the Government Operations Center (Budget 2016);

- An increase of $6.0 million in additional funding for the First Nations and Inuit Policing Program;

- An increase of $3.8 million for the renewal of the Aboriginal Community Safety Planning Initiative; and

- An increase of $3.6 million in new funding to enhance the Canada’s Firearm Control Framework.

These increases are primarily offset by the following expired program for which renewal plans are underway:

- A decrease of $8.8 million for the buy-back program for assault-style firearms and a national social marketing campaign.

Grants and Contributions (G&C) authorities have increased by $559.2 million (60.2 percent) (from $928.2 million to $1,487.4 million), which is primarily attributable to:

- An increase of $477.9 million for new funding for the Disaster Financial Assistance Arrangements (DFAA) program based on forecasts from provinces and territories for expected disbursements under the DFAA for 2022-23;

- An increase of $91.8 million in additional funding for the First Nations and Inuit Policing Program;

- An increase of $58.8 million in new funding for the Building Safer Communities Fund;

- An increase of $14.3 million in additional funding for the Initiative to Take Action Against Gun and Gang program; and

- An increase of $11.3 for new funding for the First Nation and Inuit policing facilities program.

These increases are primarily offset by the following expired programs:

- A decrease of $35.0 million for the funding to support the Canadian Red Cross’s urgent relief efforts (COVID-19);

- A decrease of $35.0 million for the funding for the Safe Restart Agreement for federal investments in testing, contact tracing and data management (COVID-19); and

- An decrease of $20.0 million for the National Disaster Mitigation Program, for which renewal plans are underway.

Budgetary Statutory authorities have increased by $1.2 million (6.8 percent) in 2022-23 primarily attributable to the Employee Benefits Plan associated with new salary funding received in Main Estimates.

2.2 Significant Variances from Previous Year Expenditures

Year-to-Date Expenditures

For the period ending September 30, 2022, the Departmental Budgetary Expenditures by Standard Object table presents a net increase of $912.0 million (349.8 percent) in Public Safety’s year-to-date (YTD) expenditures compared to the previous year (from $260.7 million to $1,172.7 million). This increase is primarily attributable to:

- An increase of $884.9 million due to an increase in advanced payment requirements related to natural disasters for the Disaster Financial Assistance Arrangements (DFAA) program;

- An increase of $27.4 million in support of payments for the Humanitarian Workforce to Respond to COVID-19 and Other Large-Scale Emergencies;

- An increase of $9.4 million in support of payments for the First Nations Policing Program; and

- An increase of $9.4 million in personnel expenditures primarily attributable to an increase in salary funding received to support the department’s initiatives;

- An increase of $6.7million in support of payments for the Building Safer Communities Fund

These increases primarily offset by the following decrease:

- A decrease of $35.6 million for payment in support of the Canadian Red Cross’s urgent relief efforts related to COVID-19, floods and wildfires.

Second Quarter Expenditures

Compared to the previous year, expenditures used during the quarter ended September 31, 2022 have increased by $828.6 million (529.4 percent) (from $156.5 million to $985.1 million) as reflected in the Departmental Budgetary Expenditures by Standard Object table.

- Personnel expenditures have increased by $5.3 million, primarily attributable to an increase in salary funding received to support the department’s initiatives.

- Other operating expenditures have increasedby $2.0 million primarily in support of the relocation and accommodations for the Government Operations Center.

- Transfer payments expenditures have increased by $822.6 million (730.3 percent) primarily attributable to:

- An increase of $820.3 million due to an increase in advanced payment requirements related to natural disasters for the Disaster Financial Assistance Arrangements (DFAA) program;

- An increase of $27.4 million in support of payments the Humanitarian Workforce to Respond to COVID-19 and Other Large-Scale Emergencies;

- An increase of $6.7 million in support of payments for the Building Safer Communities Fund;

- An increase of $5.8 million in support of payments for the Gun and Gang Violence Action Fund.

Primarily offset by the following decrease:

- A decrease of $34.2 million for payments in support of the Canadian Red Cross’s urgent relief efforts related to COVID-19, floods and wildfires; and

- A decrease of $6.4 million due to the timing of payments for the Memorial Grant Program for First Responders.

3.0 Risks and Uncertainty

Disaster Financial Assistance Arrangements

The Disaster Financial Assistance Arrangements (DFAA) contribution program presents a greater level of uncertainty than other PS grants and contributions programs given that it represents a significant portion of the PS budget and that it is subject to unforeseen events. The DFAA contribution program was established in 1970 to provide a consistent and equitable mechanism for federal sharing of provincial and territorial costs for natural disaster response and recovery where such costs would place an undue burden on a provincial or territorial economy.

There are currently 65 active natural disasters for which Orders in Council (OiC) have been approved, authorizing the provision of federal financial assistance under the DFAA, and for which final payments have not yet been made. Public Safety’s total outstanding share of liability under the DFAA with regards to these 65 events is $6.35 billion, the majority of which is expected to be paid out over the next five years.

DFAA liability has decreased by $0.82 billion from $7.17 billion in the first quarter of 2022-23 to $6.35 billion in the second quarter of 2022-23. Variations in the DFAA liability are mainly attributable to:

- Changes for newly approved OiCs, which authorize funding related to recent natural disasters for which provinces and territories require federal sharing of costs;

- Changes in the estimates of the existing natural disasters; and,

- Changes for payments issued under the existing obligation.

The following are the most significant events within Public Safety Canada’s DFAA liability:

- British Columbia 2021 November Storm ($3.0 billion);

- British Columbia 2021 Flood & Landslides ($600 million);

- Manitoba 2011 Spring Flood ($525 million);

- Alberta 2013 June Flood ($496 million);

- British Columbia 2021 Wildfires ($208 million); and,

- Quebec 2019 Spring Flood ($208 million).

Updates to the DFAA liability as a result of changes to the estimates of the existing natural disasters, are completed and approved twice a year with the last update having been conducted in Fall 2022 and will be reflected in the December 31, 2022 Quarterly Financial Report.

4.0 Significant Changes in Relation to Operations, Programs and Personnel

On July 7th 2022, Greg Kenney was appointed as Assistant Deputy Minister, Firearms Program.

On August 4th 2022, Shannon Grainger started assuming the functions of Assistant Deputy Minister of the Portfolio Affairs and Communications Branch

Significant Subsequent Events

On October 17th 2022, Shawn Tupper was appointed as Deputy Minister of Public Safety Canada.

5.0 Approval by Senior Officials

Approved as required by the Policy on Financial Resource Management, Information and Reporting:

Shawn Tupper

Deputy Minister

Public Safety Canada

Ottawa (Canada)

Date: November 28, 2022

Patrick Amyot, CPA, CMA

Chief Financial Officer

Public Safety Canada

Ottawa (Canada)

Date: November 25, 2022

6.0 Statement of Authorities (unaudited)

| Total available for use for the year ending March 31, 2023Footnote 1 | Used during the quarter ended September 30, 2022 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Net Operating Expenditures | 209,919,419 | 45,238,149 | 87,012,099 |

| Vote 5 - Grants and Contributions | 1,487,384,143 | 935,204,035 | 1,076,389,831 |

| Employee Benefit Plans (EBP) | 18,503,292 | 4,625,823 | 9,251,646 |

| Minister's Salary and Motor Car Allowance | 92,500 | 23,100 | 46,200 |

| Total Authorities | 1,715,899,354 | 985,091,107 | 1,172,699,776 |

| Total available for use for the year ended March 31, 2022Footnote 2 | Used during the quarter ended September 30, 2021 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Net Operating Expenditures | 200,426,284 | 39,876,527 | 75,396,597 |

| Vote 5 - Grants and Contributions | 928,170,860 | 112,631,491 | 177,337,300 |

| Employee Benefit Plans (EBP) | 17,323,729 | 3,982,357 | 7,964,715 |

| Minister's Salary and Motor Car Allowance | 90,500 | 22,675 | 45,350 |

| Total Authorities | 1,146,011,373 | 156,513,050 | 260,743,962 |

7.0 Departmental budgetary expenditures by Standard Object (unaudited)

| Planned expenditures for the year ending March 31, 2023Footnote 3 | Expended during the quarter ended September 30, 2022 | Year to date used at quarter-end | |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 143,030,141 | 41,048,095 | 78,766,798 |

| Transportation and communications | 3,054,804 | 397,500 | 655,231 |

| Information | 5,672,708 | 1,616,223 | 1,896,266 |

| Professional and special services | 24,883,761 | 3,696,944 | 10,339,111 |

| Rentals | 6,435,760 | 1,067,342 | 2,333,007 |

| Repair and maintenanceFootnote 4 | 2,070,965 | 3,468,370 | 3,474,947 |

| Utilities, material and supplies | 584,362 | 54,088 | 99,958 |

| Acquisition of land, buildings and worksFootnote 5 | 37,948,516 | - | - |

| Acquisition of machinery and equipment | 4,565,516 | 196,460 | 405,553 |

| Transfer payments | 1,487,384,143 | 935,204,035 | 1,076,389,831 |

| Public debt charges | - | - | - |

| Other subsidies and payments | 2,968,678 | 254,112 | 323,136 |

| Total gross budgetary expenditures | 1,718,599,354 | 987,003,169 | 1,174,683,838 |

| Less Revenues netted against expenditures: | |||

| Interdepartmental Provision of Internal Support Services | 2,700,000 | 1,912,062 | 1,984,062 |

| Total net budgetary expenditures | 1,715,899,354 | 985,091,107 | 1,172,699,776 |

| Planned expenditures for the year ending March 31, 2022Footnote 6 | Expended during the quarter ended September 30, 2021 | Year to date used at quarter-end | |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 136,960,020 | 35,781,605 | 69,347,192 |

| Transportation and communications | 3,593,085 | 84,663 | 123,902 |

| Information | 5,177,048 | 1,940,063 | 2,149,017 |

| Professional and special services | 27,884,982 | 4,689,827 | 9,564,057 |

| Rentals | 5,305,293 | 1,119,584 | 2,681,732 |

| Repair and maintenance | 1,894,754 | 95,654 | 100,495 |

| Utilities, material and supplies | 530,734 | 84,263 | 98,836 |

| Acquisition of land, buildings and worksFootnote 7 | 32,412,671 | - | - |

| Acquisition of machinery and equipment | 3,854,187 | 251,122 | 284,210 |

| Transfer payments | 928,170,860 | 112,631,491 | 177,337,300 |

| Public debt charges | - | - | - |

| Other subsidies and payments | 2,927,739 | 490,778 | 818,356 |

| Total gross budgetary expenditures | 1,148,711,373 | 157,169,050 | 262,505,097 |

| Less Revenues netted against expenditures: | |||

| Interdepartmental Provision of Internal Support Services | 2,700,000 | 656,000 | 1,761,135 |

| Total net budgetary expenditures | 1,146,011,373 | 156,513,050 | 260,743,962 |

- Date modified: