Public Safety Canada Quarterly Financial Report for the quarter ended June 30, 2023

Table of Contents

- 1.0 Introduction

- 2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

- 3.0 Risks and Uncertainty

- 4.0 Significant Changes in Relation to Operations, Programs and Personnel

- 5.0 Approval by Senior Officials

- 6.0 Statement of Authorities (unaudited)

- 7.0 Departmental budgetary expenditures by Standard Object (unaudited)

1.0 Introduction

This quarterly financial report for the period ending June 30, 2023 has been prepared by management as required by section 65.1 of the Financial Administration Act, in the form and manner prescribed by Treasury Board. The report should be read in conjunction with the Main Estimates.

This quarterly financial report has not been subject to an external audit or review. However, it has been reviewed by the Departmental Audit Committee prior to approval by the Deputy Minister.

Information on the mandate, roles, responsibilities and programs of Public Safety Canada can be found in the 2023-24 Departmental Plan and the 2023-24 Main Estimates.

1.1 Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities table includes the Department’s spending authorities granted by Parliament, or received from Treasury Board Central Votes, and those used by the Department consistent with the Main Estimates for the 2023-24 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet the information needs concerning the use of spending authorities.

The authority of Parliament is required before funds can be spent by the Government. Approvals are given in the form of annually approved limits through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

Public Safety Canada uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis, as do the expenditures presented in this report.

2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

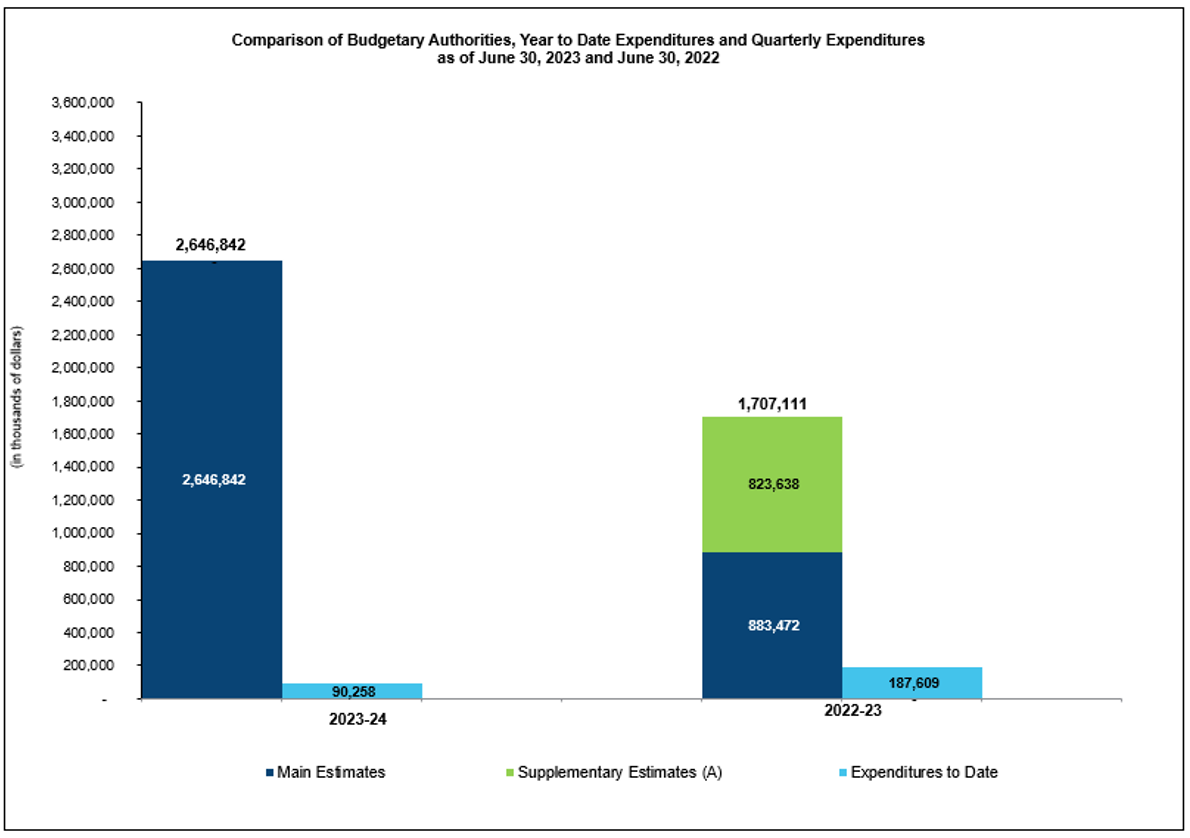

The following graph provides a comparison of the net budgetary authorities and expenditures as of June 30, 2023 and June 30, 2022 for the Department’s combined:

- Vote 1: Operating Expenditures;

- Vote 5: Grants and Contributions;

- Statutory Votes:

- Employee Benefit Plans; and

- Minister’s Salary and Car Allowance.

Image description

Budgetary Authorities and Expenditures Comparison

Starting from the left hand side, the “first” column in the graph indicates that the Department authorities are at $2,646.8 million for fiscal year 2023-24. The year-to-date expenditures of $90.3 million reported at the end of the first quarter of the 2023-24 fiscal year are shown under the “second” column. The “third” column in the graph depicts the 2022-23 authorities which were at $1,707.1 million at the end of June 2022. The 2022-23 year-to-date expenditures of $187.6 million reported at the end of the first quarter of the 2022-23 fiscal year are shown under the “fourth” column.

2.1 Significant Changes to Authorities

For the period ending June 30, 2023, the authorities provided to the Department include Main Estimates. The 2022-23 authorities for the same period included the Main Estimates and Supplementary Estimates (A). The Statement of Authorities table presents a net increase of $939.7 million (55.0 percent) compared to those of the same period of the previous year (from $1,707.1 million to $2,646.8 million).

Operating Expenditures authorities have increased by $3.4 million (1.7 percent) (from $201.1 million to $204.5 million), which is primarily attributable to:

- An increase of $7.6 million in new funding to support the design and development of the Firearms Buyback Program for prohibited assault style firearms;

- An increase of $5.0 million in additional funding to improve the federal emergency management capacity;

- An increase of $2.3 million in new funding to build Canada’s Research Security Capacity;

- An increase of $1.9 million for the renewal of the National Strategy for Protecting Children from Sexual Exploitation Online program;

- An increase of $1.8 million for the renewal of the Indigenous Community to address the needs of vulnerable offenders in the federal correctional system;

- An increase of $1.5 million in new funding for Government advertising programs;

- An increase of $1.4 million in new funding for the National Security Framework; and

- An increase of $1.1 million for the new collective agreements.

These increases are primarily offset by the following decrease:

- A decrease of $15.4 million for the relocation and accommodations of the Government Operations Center (Budget 2016);

- A decrease of $2.4 million due to the expiry of the funding for the Initiative to Take Action Against Gun and Gang Violence which renewal is underway; and

- A decrease of $1.7 million in funding levels for the First Nations and Inuit Policing Program for which there are plans underway to renew and to augment funding.

Grants and Contributions (G&C) authorities have increased by $934.4 million (62.8 percent) (from $1,487.4 million to $2,421.8 million), which is primarily attributable to:

- An increase of $801.3 million in new funding related to the Disaster Financial Assistance Arrangements (DFAA) program based on forecasts from provinces and territories for expected disbursements under the DFAA for 2023-24;

- An increase of $67.7 million in funding levels for the First Nations and Inuit Policing Program;

- An increase of $55.5 million in additional funding for the Memorial Grant Program for First Responders;

- An increase of $26.3 million in additional funding for the Building Safer Communities Fund;

- An increase of $16.3 million to matching of donations raised by the Canadian Red Cross in response to the 2021 British Columbia flood and wildfire events; and

- An increase of $14.8 million in funding levels for First Nations and Inuit Policing Facilities program.

These increases are primarily offset by the following decrease:

- A decrease of $75.6 million due to the expiry of the funding for the Initiative to Take Action Against Gun and Gang Violence which renewal is underway.

Budgetary Statutory authorities haveincreased by $1.9 million (10.3 percent) in 2023-24 primarily attributable to the Employee Benefits Plan associated with new salary funding received in Main Estimates.

2.2 Significant Variances from Previous Year Expenditures

First Quarter Expenditures

Compared to the previous year, expenditures used during the quarter ended June 30, 2023 have decreased by $97.3 million (51.9 percent) (from $187.6 million to $90.3 million) as reflected in the Departmental Budgetary Expenditures by Standard Object table.

- Operating expenditures have increased by $7.2 million (17.2 percent) primarily attributable to:

- Personnel expenditures have increased by $7.0 million (18.6 percent), primarily attributable to an increase in staffing requirements to support the advancement of the department’s agenda.

- Transfer payment expenditures have decreased by $105.1 million (74.4 percent) primarily attributable to:

- A decrease of $64.6 million due to the timing of payments for the Disaster Financial Assistance Arrangements (DFAA) program;

- A decrease of $29.5 million due to the timing in payments for the First Nations and Inuit Policing Program;

- A decrease of $14.4 million due to the timing of payments for the Memorial Grant Program for First Responders; and

- A decrease of $1.2 million due to the timing of payments for the Search and Rescue New Initiatives Fund.

- Primarily offset by the following increases:

- An increase of $1.5 million due to timing of payments for the First Nations and Inuit Policing Facilities Program; and

- An increase of $1.2 million due to the timing of payments to support the Building Safer Communities Fund.

3.0 Risks and Uncertainty

Disaster Financial Assistance Arrangements

The Disaster Financial Assistance Arrangements (DFAA) contribution program presents a greater level of uncertainty than other PS grants and contributions programs given that it represents a significant portion of the PS budget and that it is subject to unforeseen events. The DFAA contribution program was established in 1970 to provide a consistent and equitable mechanism for federal sharing of provincial and territorial costs for natural disaster response and recovery where such costs would place an undue burden on a provincial or territorial economy.

There are currently 73 active natural disasters for which Orders in Council (OiC) have been approved, authorizing the provision of federal financial assistance under the DFAA, and for which final payments have not yet been made. Public Safety’s total outstanding share of liability under the DFAA with regards to these 73 events is $4.8 billion, the majority of which is expected to be paid out over the next five years.

DFAA liability has increased by $0.1 billion from $4.7 billion in the third quarter of 2022-23 to $4.8 billion in the first quarter of 2023-24. Variations in the DFAA liability are mainly attributable to:

- Changes for newly approved OiCs, which authorize funding related to recent natural disasters for which provinces and territories require federal sharing of costs;

- Changes in the estimates of the existing natural disasters; and,

- Changes for payments issued under the existing obligation.

The following are the most significant events within Public Safety Canada’s DFAA liability:

- British Columbia 2021 November Storm ($1.6 billion);

- British Columbia 2021 Flood & Landslides ($714 million);

- British Columbia 2020 Flood & Landslides ($317 million);

- Alberta 2013 June Flood ($205 million);

- British Columbia 2021 Wildfires ($192 million); and

- Manitoba 2011 Spring Flood ($171 million).

Updates to the DFAA liability as a result of changes to the estimates of the existing natural disasters, are completed and approved twice a year with the last update having been conducted in Winter 2022-23 and is reflected in the current Quarterly Financial Report.

4.0 Significant Changes in Relation to Operations, Programs and Personnel

On March 27, 2023, Patrick Boucher was appointed as the Senior Assistant Deputy Minister for the National and Cyber Security Branch.

5.0 Approval by Senior Officials

Approved as required by the Policy on Financial Resource Management, Information and Reporting:

Shawn Tupper

Deputy Minister

Public Safety Canada

Ottawa (Canada)

Date: August 21, 2023

John McKinley, CPA, MBA for

Patrick Amyot, CPA, CMA

Chief Financial Officer

Public Safety Canada

Ottawa (Canada)

Date: August 18, 2023

6.0 Statement of Authorities (unaudited)

| Total available for use for the year ending March 31, 2024Footnote 1 | Used during the quarter ended June 30, 2023 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Net Operating Expenditures | 204,526,475 | 48,951,713 | 48,951,713 |

| Vote 5 - Grants and Contributions | 2,421,776,944 | 36,120,442 | 36,120,442 |

| Employee Benefit Plans (EBP) | 20,444,116 | 5,162,457 | 5,162,457 |

| Minister's Salary and Motor Car Allowance | 94,700 | 23,700 | 23,700 |

| Total Authorities | 2,646,842,235 | 90,258,312 | 90,258,312 |

| Total available for use for the year ended March 31, 2023Footnote 2 | Used during the quarter ended June 30, 2022 | Year to date used at quarter-end | |

|---|---|---|---|

| Vote 1 - Net Operating Expenditures | 201,130,701 | 41,773,950 | 41,773,950 |

| Vote 5 - Grants and Contributions | 1,487,384,143 | 141,185,796 | 141,185,796 |

| Employee Benefit Plans (EBP) | 18,503,292 | 4,625,823 | 4,625,823 |

| Minister's Salary and Motor Car Allowance | 92,500 | 23,100 | 23,100 |

| Total Authorities | 1,707,110,636 | 187,608,669 | 187,608,669 |

7.0 Departmental budgetary expenditures by Standard Object (unaudited)

| Planned expenditures for the year ending March 31, 2024Footnote 3 | Expended during the quarter ended June 30, 2023 | Year to date used at quarter-end | |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 155,039,582 | 44,724,662 | 44,724,662 |

| Transportation and communications | 1,700,385 | 515,719 | 515,719 |

| Information | 8,386,536 | 870,544 | 870,544 |

| Professional and special services | 27,394,529 | 5,800,351 | 5,800,351 |

| Rentals | 7,322,908 | 604,008 | 604,008 |

| Repair and maintenanceFootnote 4 | 1,501,713 | 9,697 | 9,697 |

| Utilities, material and supplies | 605,202 | 59,475 | 59,475 |

| Acquisition of land, buildings and works | 18,893,082 | 0 | 0 |

| Acquisition of machinery and equipment | 4,072,578 | 754,968 | 754,968 |

| Transfer payments | 2,421,776,944 | 36,120,442 | 36,120,442 |

| Public debt charges | 0 | 0 | 0 |

| Other subsidies and payments | 2,848,776 | 1,264,566 | 1,264,566 |

| Total gross budgetary expenditures | 2,649,542,235 | 90,724,432 | 90,724,432 |

| Less Revenues netted against expenditures: | |||

| Interdepartmental Provision of Internal Support Services | 2,700,000 | 466,120 | 466,120 |

| Total net budgetary expenditures | 2,646,842,235 | 90,258,312 | 90,258,312 |

| Planned expenditures for the year ending March 31, 2023Footnote 5 | Expended during the quarter ended June 30, 2022 | Year to date used at quarter-end | |

|---|---|---|---|

| Expenditures: | |||

| Personnel | 141,951,074 | 37,718,703 | 37,718,703 |

| Transportation and communications | 2,806,975 | 257,731 | 257,731 |

| Information | 5,212,494 | 280,043 | 280,043 |

| Professional and special services | 22,864,997 | 6,642,167 | 6,642,167 |

| Rentals | 5,913,641 | 1,265,665 | 1,265,665 |

| Repair and maintenanceFootnote 6 | 1,902,952 | 6,578 | 6,578 |

| Utilities, material and supplies | 536,954 | 45,870 | 45,870 |

| Acquisition of land, buildings and works | 34,314,444 | 0 | 0 |

| Acquisition of machinery and equipment | 4,195,126 | 209,093 | 209,093 |

| Transfer payments | 1,487,384,143 | 141,185,796 | 141,185,796 |

| Public debt charges | 0 | 0 | 0 |

| Other subsidies and payments | 2,727,836 | 69,024 | 69,024 |

| Total gross budgetary expenditures | 1,709,810,636 | 187,680,670 | 187,680,670 |

| Less Revenues netted against expenditures: | |||

| Interdepartmental Provision of Internal Support Services | 2,700,000 | 72,000 | 72,000 |

| Total net budgetary expenditures | 1,707,110,636 | 187,608,670 | 187,608,670 |

- Date modified: