An Overview of Financial Administration in the Government

The following is to provide a brief overview of the financial administration in the government.

Funding for New Initiatives

- The Minister of Finance develops the Budget with the support of the Department of Finance Canada, which analyzes the fiscal implications of budget proposals, in close consultation with the Prime Minister and the Privy Council Office. The federal budget reveals the government’s priorities, policies and plans.

- Typically on an annual basis, each Minister is asked to provide a submission to the Minister of Finance including the funding needed to deliver on their priorities, policies and plans.

- A funding request can also be made through an off-cycle funding request to the Minister of Finance.

- Funding decisions are distinct from policy decisions. A decision on a policy proposal is sought from the Cabinet through a Memorandum to Cabinet.

- The Treasury Board submission is then used to seek specific authorities or approvals from the Treasury Board to help implement a new initiative.

- The financial impact of the Treasury Board submission will be reflected in the Estimates process.

- Parliament authorizes government spending through the Estimates and the associated Appropriation Bills. This process is often called the business of supply.

- The Departmental reference levels (or financial authorities) are defined as the amount of funding Treasury Board (TB) approves to carry out the Department’s approved policies and programs

- An analysis of the reference levels is performed to maintain existing programs and services, and to incorporate adjustments to program funding levels approved by the Treasury Board. This process is called the Annual Reference Level Update, which is the basis for the development of the Main Estimates.

- The Main Estimates present the government’s appropriation needs for each organization, for a given fiscal year starting on April 1st. Parliament votes on interim supply (3/12th of budget for the fiscal year) and full supply (remaining 9/12th of budget).

- Given that the Main Estimates do not include the government’s complete spending needs for the year, such as unanticipated spending needs or items announced in the budget, the government also presents supplementary estimates to Parliament for review and approval. The government tends to present supplementary estimates in May, November and February, and each set of supplementary estimates receives an alphabetical designation – A, B or C.

The Parliamentary Financial Cycle

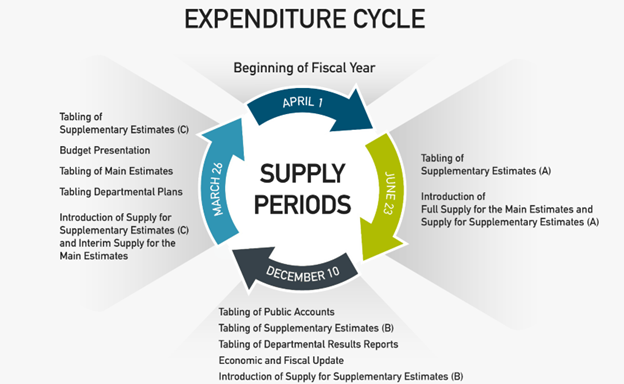

- The fiscal year begins on April 1st and concludes on March 31st and follows a loop of activities divided into before, during, and after fiscal year sections as outlined below.

Image Description

Expenditure Cycle

Supply Periods

April 1

Beginning of fiscal year

June 23

Tabling of Supplementary Estimates (A)

Introduction of Full Supply for Main Estimates and Supply for Supplementary Estimates (A)

December 10

Tabling of Public Accounts

Tabling of Supplementary Estimates (B)

Tabling of Departmental Results Reports

Economic and Fiscal Update

Introduction of Supply for Supplementary Estimates (B)

March 26

Tabling of Supplementary Estimates (C)

Budget Presentation

Tabling of Main Estimates

Tabling of Departmental Plans

Introduction of Supply for Supplementary Estimates (C) and Interim Supply for Main Estimates

Before the Fiscal Year

- In the fall, the House of Commons Standing Committee on Finance holds pre-budget consultations during which it seeks the views of Canadians on what recommendations it should make to the Minister of Finance for the government’s upcoming budget.

- In February or March, the Minister of Finance presents the government’s budget, which outlines the government’s taxation and spending priorities for the coming fiscal year.

- On or before March 1st the government tables its main estimates for the coming fiscal year. The main estimates are prepared in the late fall, and thus generally do not include spending items announced in the budget.

- Later in March, the government tables departmental plans. These plans set out the results that departments intend to achieve with the resources provided to them, and they outline the human and financial resources allocated to each program.

- Before the beginning of the fiscal year, the House of Commons approves interim supply. As full supply is not granted until June, the government needs authorization to spend funds during the first three months of the fiscal year. Thus, interim supply is usually three-twelfths of the amount outlined in the main estimates.

During the Fiscal Year

- To obtain approval for additional funding, the government submits supplementary estimates to Parliament. Generally the government submits three supplementary estimates during the fiscal year – in the spring, fall and winter – and each supplementary estimate is designated by a letter: supplementary estimates A, supplementary estimates B, and C.

- In the fall, the Minister of Finance presents an economic and fiscal update, which provides mid-year information on the country’s economic growth and the state of the government’s finances.

- Throughout the year, federal departments prepare and make public quarterly financial reports, which compare planned with actual expenditures.

After the Fiscal Year

- Sometime after the end of the fiscal year (usually in October), the government presents its public accounts, which outline the government’s actual spending during the year.

- Also in the fall, the government releases departmental results reports for each department and agency. These reports describe achievements relative to the expectations outlined in the corresponding departmental plans.

Minister’s Office budget

- Ministers’ Office (MO) budgets are subject to close governmental and parliamentary scrutiny. As a result, Treasury Board (TB) requires that “the expenditure of funds in [MO] budgets must be made only with the usual high standards of prudence and probity.” To ensure these standards are upheld, TB has put in place special rules for the management of both the exempt staff budget and the operating cost budget.

- Ministers are answerable to TB and personally accountable to Parliament for the expenditures of their office. MO budgets may not be exceeded and the Public Accounts provide annual detailed reporting of MO spending in addition to routine proactive disclosure. MO expenditures are part of the Department’s Vote 1 appropriation and as such the DM is the responsible accounting officer for them and they are subject to the Department’s internal audit function.

- Authority to initiate and approve expenditures may be delegated by the Minister to the Chief of Staff or other senior staff. The Department will prepare the necessary delegation instruments to reflect the Minister’s preferences regarding the individuals in the office who will manage the MO budget.

- Responsibility for hiring, pay, or termination of exempt staff falls to the Minister, and cannot be delegated. The Minister may configure staff complement as one sees fit within the prescribed budget, subject to TB rules and direction from the Prime Minister’s Office.

The Department’s Chief Financial Officer’s team would be pleased to provide you and your staff more detail about financial comptrollership including on delegations of financial authority, travel and hospitality management.

- Date modified: