Beyond the Border Action Plan: Horizontal Initiative Report 2015-16

Table of contents

- Introduction

- Overview

- Theme 1: Addressing Threats Early

- Theme 2: Trade Facilitation, Economic Growth and Jobs

- Theme 3: Cross-Border Law Enforcement

- Theme 4: Critical Infrastructure and Cyber Security

- Initiatives 33 and 34: Managing our New Long-Term Partnership

- Appendix A: List of Beyond the Border Action Plan Initiatives

- Appendix B: Cumulative Spending to Date by Initiative

- Endnotes

Addressing the Auditor General of Canada's recommendations for the Beyond the Border Action Plan

The Auditor General of Canada's (AG's) Fall 2016 report included a chapter on the audit of the Beyond the Border Action Plan which included recommendations on the horizontal reporting process.

As a result, in this 2015-16 horizontal initiative report, we've begun addressing some of the AG's recommendations. Notable changes include:

- providing cumulative financial spending by theme and by initiative;

- reporting on variances between planned and actual spending calculated by initiative instead of by theme (as done previously) for greater clarity;

- updating narrative text at the front of the report that offers more context as well as a high-level summary of achievements to-date;

- including historical information for each initiative gleaned from previous reports to give a more complete picture of progress to-date on BTB initiatives; and

- offering new content at the beginning of each of the four themes referencing commitments made under the Action Plan.

The Government of Canada will address the remaining recommendations in the 2016-17 close-out report for the BTB Action Plan, expected to be released in 2018.

At that time, you'll see stronger, clearer, more measurable performance indicators as well as more comprehensive narrative text to communicate results. As well, the report will include a complete picture of planned and actual financial spending—for each organization—over the entire five-year duration of the Action Plan.

Going forward, those initiatives that will carry on past the Action Plan's commitment dates will be reported on by individual organizations in their own Departmental Results reports.

Introduction

On February 4, 2011, Canada and the United States (U.S.) committed to working together through Beyond the Border: A Shared Vision for Perimeter Security and Economic Competitiveness. The Declaration initiated a new long-term partnership between the two countries built upon a perimeter approach to security and economic competitiveness. The Beyond the Border (BTB) Action Plan,Note 1 released in December 2011, set out specific initiatives to secure the Canada-U.S. border and perimeter while facilitating legitimate trade and travel. This horizontal initiative aims to enhance our collective security and accelerate the flow of legitimate goods, services, and people, both at and beyond the border.

Much has been accomplished since 2011 to achieve the overall objectives of the Action Plan and the Government of Canada has been working closely with its U.S. counterparts in ensuring its success.

The Action Plan sets out joint priorities for achieving a secure and efficient Canada-U.S. border within four areas of cooperation:

- Addressing Threats Early – Threats are stopped before they arrive either in Canada or in the U.S.;

- Trade Facilitation, Economic Growth and Jobs – Legitimate travel and cargo is stimulated and expedited;

- Cross-Border Law Enforcement – Criminals are prevented from leveraging the Canada-U.S. border to commit international crimes; and,

- Critical Infrastructure and Cyber Security – Canada and the U.S. are prepared for and can respond to threats and emergencies.

In total, 32 initiatives are grouped under these four areas; two additional initiatives cover the responsible sharing of personal information and centralized oversight of the Action Plan's implementation.

For more information and descriptions of Action Plan initiatives, please consult the Beyond the Border Action Plan.

The final year of the Action Plan is 2016-17 with one more Horizontal Initiative Report remaining to be issued. This report provides a cumulative view of progress made up to and including the current reporting year (April 1, 2015-March 31, 2016). While this report focuses on Canadian progress to date in meeting Action Plan commitments since its inception, joint Canada-U.S. Implementation Reports have been released annually—with the last oneNote 2 published in the summer of 2016.

In preparing this report, Public Safety Canada (PS) collects updated information and performance data from all federal BTB organizations that are working on the 32 themed initiatives. These departments and agencies are currently wrapping up remaining work towards implementing the BTB initiatives for which they are responsible. Additional details can be found in each organization's annual Departmental Results Report (DRR).

Since the launch of the Action Plan in 2011 and up to the current March 31, 2016 reporting period, eleven of 34 initiatives have been completed.

Under Theme 1, Canada and the U.S. now have a greater understanding of each other's legal, policy and operational frameworks governing information sharing for national security processes. Cooperation is not limited to security issues alone; for example, joint food, plant and animal assessments are now conducted on third party countries.

As of March 31, 2016, Passenger Baggage Screening (initiative 6) was nearly finished, with the U.S. Transportation Security Administration's (TSA) rescreening requirement lifted at five airports, two airports having fully deployed new Explosive Detection System equipment (and are awaiting the formal lifting of the rescreening requirement) and the last airport expected to deploy the technology by fall 2016.

Agreements regarding visa and immigration information sharing as well as the sharing of information on asylum and refugee claimants have been successful as they assist Canadian officials in verifying applicants' identities, provide new immigration information, and facilitate the travel of low-risk individuals. In addition, Canada and the U.S. have successfully launched an automated biometric-based query capability in order to counter identity fraud, strengthen identity management and provide valuable information to inform respective admissibility determinations. Canada has also completed the implementation of the Electronic Travel Authorization (eTA) program which allows the government to screen visa-exempt foreign nationals (except U.S. citizens) at the earliest opportunity—before they board a plane to Canada.

Results of Theme 2 initiatives include an increase of membership and expansion of benefits for the Nexus trusted traveller program which contributes to more effective management of the border and an enhanced traveller experience.

Benefits for Trusted Traders and Travellers (initiatives 12, 13 and 14) have expanded under the Action Plan. The application processes have been streamlined and broadened, and the infrastructure for processing Trusted Traders and Travellers has increased as well. Up to $127 million in funding to expand and modernize facilities at key crossings has been announced and upgrades to four ports of entry are underway (initiative 20).

As well, Canada and the U.S. have aligned their low-value shipment threshold for expedited customs clearance. The corresponding increase in the volume of shipments has not adversely impacted processing times—99% are processed on the same day.

Bi-National Port Operations Committees have been established to ensure cooperation and partnering to enhance collaboration on overall port of entry management, to coordinate emergency responses and preparedness, to integrate enforcement efforts, and to improve the efficiency of mitigation strategies for border wait times. These bi-national committees will continue to meet at least four times per year.

As well, a significant milestone was achieved in March 2015 when Canada and the U.S. signed the new Land, Rail, Marine, and Air Transport Preclearance Agreement (LRMA), opening up the possibility of preclearance in all modes of travel and on both sides of the border. Work continues to advance implementation of LRMA.

Theme 3 results include progress on the Shiprider initiative with Canada-U.S. officers increasingly enforcing laws and regulations on our shared waterways with the addition of two more operational units in 2015-16; namely, in Kingston and Niagara.

Under Theme 4, activities on the critical infrastructure protection and cybersecurity (initiatives 27, 28 and 29) fronts have included approximately 150 all-hazards assessments and three cross-border assessments completed under the Regional Resilience Assessment Program (RRAP) and Virtual Risk Analysis Cell (VRAC), which address critical infrastructure physical security, resiliency, and cyber security.

Canada has also demonstrated its joint leadership on international cyber security efforts through the ratification of the Council of Europe Convention on Cybercrime (Budapest Convention) in 2015. That Convention is the only international instrument to address cybercrime and the acquisition of digital evidence for criminal justice purposes. It covers not only cybercrimes, such as hacking, but also requires all States Parties to criminalize and assist in the investigation of content offences such as child pornography and other Internet crimes such as fraud.

Finally, a cross-cutting initiative, shared privacy principles, was the first completed deliverable under the Action Plan. The Canada-U.S. Joint Statement of Privacy PrinciplesNote 3 were published in June 2012. These principles have been applied to a number of arrangements under the Action Plan and will be applied to future collaborations under the final phase of the Entry/Exit initiative, among others.

Overview

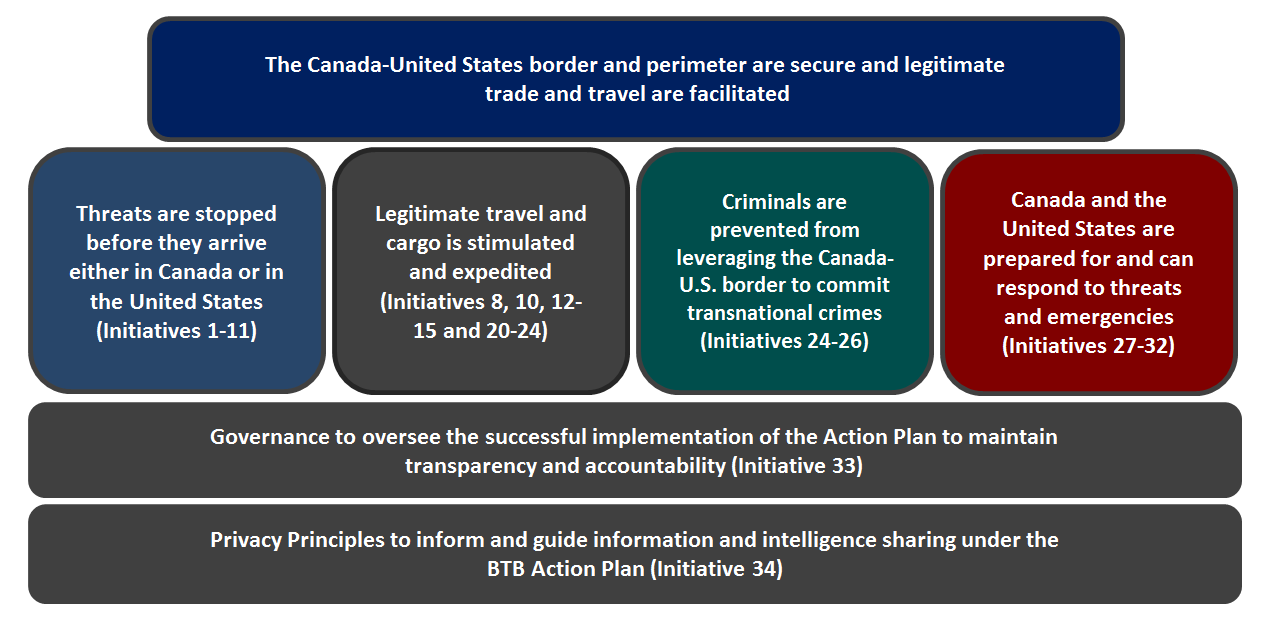

The figure below illustrates the outcomes to which the 34 Beyond the Border initiatives contribute. The four overarching outcomes support the achievement of a secure Canada-U.S. border and perimeter, and the facilitation of legitimate trade and travel. This figure presents the structure used in the report to demonstrate progress on the BTB initiatives.

Beyond the Border Action Plan Ultimate Outcomes

Image description

This image illustrates the Beyond the Border Action Plan's desired outcomes. There are five ultimate outcomes and two governance-related outcomes which are all linked to specific Beyond the Border Action Plan initiatives. The outcomes are as follows:

Ultimate Outcomes:

The Canada – United States border and perimeter are secure and legitimate trade and travel are facilitated (all Beyond the Border Action Plan initiatives)

Threats are stopped before they arrive either in Canada or in the United States (Initiatives 1-11)

Legitimate travel and cargo are stimulated and expedited (Initiatives 8, 10, 12-15 and 20-24)

Criminals are prevented from leveraging the Canada- United States border to commit transnational crimes (Initiatives 24-26)

Canada and the United States are prepared for and can respond to threats and emergencies (Initiatives 27-32)

Governance Outcomes:

Governance oversees the successful implementation of the Action Plan to maintain transparency and accountability (Initiative 33)

Privacy principles inform and guide information and intelligence-sharing under the BTB Action plan (Initiative 34)

The following table presents the total planned and actual spending figures under the BTB Action Plan for the 2015-16 fiscal year. Breakdowns of these amounts, by participating department/agency, are presented under the different Themes in this report.

BTB Themes |

2015-16 (in dollars) |

Cumulative Actual Spending to Date (2012-2016) |

|||

|---|---|---|---|---|---|

New Funding |

Internal Reallocation |

Total Planned Spending |

Actual Spending |

||

Theme 1 - Addressing Threats Early (Initiatives 1-11) |

$100,352,380 |

$28,423,411 |

$128,775,791 |

$110,350,650 |

$367,267,668 |

Theme 2 - Trade Facilitation, Economic Growth and Jobs (Initiatives 12-24) |

$92,709,732 |

$8,710,430 |

$101,420,162 |

$62,698,301 |

$165,927,164 |

Theme 3 - Cross-Border Law Enforcement (Initiatives 25 and 26) |

$22,538,678 |

$471,437 |

$23,010,115 |

$9,979,381 |

$28,810,970 |

Theme 4 - Critical Infrastructure and Cyber Security (Initiatives 27-32) |

$2,609,006 |

$33,000 |

$2,642,006 |

$3,101,447 |

$13,516,945 |

Managing our New Long-Term Partnership (Initiatives 33 and 34) |

$0 |

$410,380 |

$410,380 |

$1,392,550 |

$6,103,799 |

TOTAL |

$218,209,796 |

$38,048,658 |

$256,258,454 |

$187,522,329 |

$581,626,546 |

Total expenditures in 2015-16 amounted to $187,522,329 against $256,258,454 in planned spending, which presents a variance of 26. 8%. Comparatively, in 2014-15 planned spending amounted to $244,722,823 against $190,003,160 in actual spending (22% variance). Where a variance (≥25%) is presented by a department/agency under a specific initiative, an explanatory note has been included at the end of the report.

Theme 1: Initiatives 1-11

Addressing Threats Early

Addressing threats at the earliest possible point strengthens the shared security of Canada and the United States; and it enables both countries to improve the flow of legitimate goods and people across the Canada-U.S. border.

Under the Action Plan, both countries committed to developing a common approach to assessing threats and identifying those who pose a risk, under the principle that a threat to either country represents a threat to both. Underneath that umbrella, both countries sought to enhance their shared understanding of the threat environment through joint integrated threat assessments, and improvements to their intelligence and national security information sharing. The Action Plan also included work to enhance domain awareness in the air, land and marine environments, and cooperation on countering violent extremism.

Once threats are identified, steps are being taken to stop them—before they occur on either Canadian or U.S. soil. This includes better protecting our countries from offshore food-safety, animal and plant health risks by conducting joint assessments and audits of those systems in third countries. The agreement also explored implementing a harmonized approach to screening inbound cargo arriving from offshore to increase security while also expediting movement of this secured cargo across the Canada-U.S. border. Under the principle that cargo should be "cleared once, accepted twice." Beyond cargo, mutually recognized passenger baggage screening (as new technology is deployed and implemented) facilitates movement across our shared border.

Common approaches to perimeter and traveller screening promote security and border efficiency. This involves sharing relevant information to improve immigration and border determinations, establishing and verifying the identities of travellers, and conducting screening at the earliest possible opportunity. It also involves establishing and coordinating entry and exit information systems, including a system which permits sharing information so that the record of a land entry into one country is used to establish an exit record from the other.

OutcomesNote 4

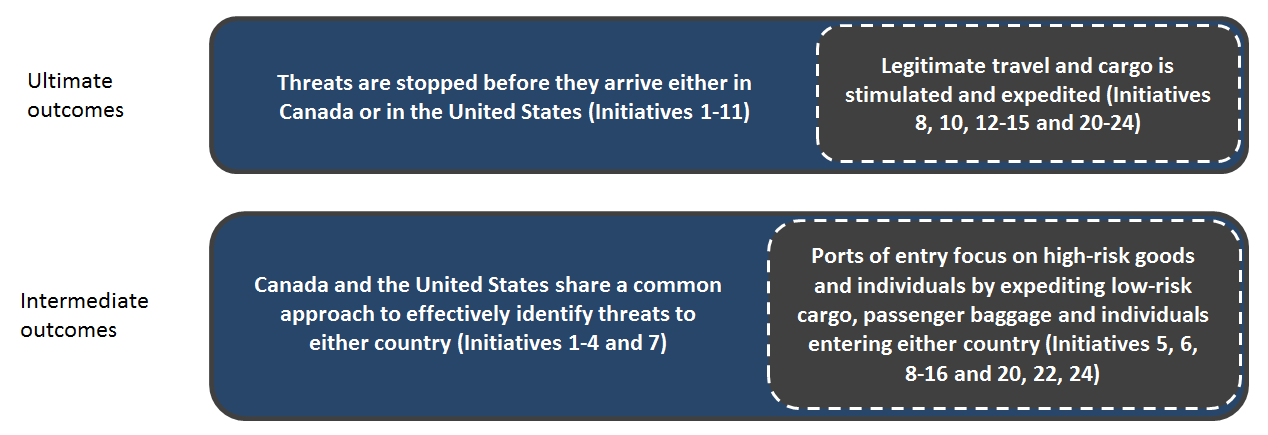

Image description

This image illustrates the outcomes of Theme 1 of the Beyond the Border Action Plan. This theme is called Addressing Threats Early. The figure demonstrates the linkages between the Intermediate Outcomes and the Ultimate Outcomes for Theme 1. The outcomes are also linked to specific Beyond the Border Action Plan initiatives.

The Intermediate Outcomes for Theme 1 are:

Canada and the United States share a common approach to effectively identify threats to either country (Initiatives 1-4 and 7)

Also, in dotted lines is an outcome stating that Ports of entry focus on high-risk goods and individuals by expediting low-risk cargo, passenger baggage and individuals entering either country (Initiatives 5, 6, 8-16 and 20, 22, 24). This is an intermediate outcome which is shared between Theme 1 and Theme 2. Theme 2 is called Trade Facilitation, Economic Growth and Jobs.

The Ultimate Outcomes for Theme 1 are:

Threats are stopped before they arrive either in Canada or in the United States (Initiatives 1-11).

Also, in dotted lines is an outcome stating that Legitimate travel and cargo is stimulated and expedited (Initiatives 8, 10, 12-15 and 20-24). This is an ultimate outcome which is shared between Theme 1 and Theme 2.

Department/Agency |

2015-16 (in dollars) |

Cumulative Spending to Date (2012-2016) |

|||

|---|---|---|---|---|---|

New Funding |

Internal Reallocation |

Total Planned Spending |

Actual Spending |

||

Canada Border Services Agency (CBSA) |

$45,742,025 |

$0 |

$45,742,025 |

$41,838,268 |

$135,240,023Note i |

Canadian Food Inspection Agency (CFIA) |

$0 |

$0 |

$0 |

$76,800 |

$504,160Note ii |

Immigration, Refugees and Citizenship Canada (IRCC) |

$49,439,973 |

$0 |

$49,439,973 |

$34,939,686 |

$84,867,366Note iii |

Immigration & Refugee Board (IRB) |

$1,612,318 |

$0 |

$1,612,318 |

$1,080,027 |

$3,369,931Note iv |

Public Safety Canada (PS) |

$0 |

$289,087 |

$289,087 |

$257,983 |

$1,093,567Note v |

Royal Canadian Mounted Police (RCMP) |

$2,504,859 |

$0 |

$2,504,859 |

$4,148,457 |

$13,202,295Note vi |

Shared Services Canada (SSC) |

$653,205 |

$0 |

$653,205 |

$653,205 |

$2,918,383 |

Transport Canada (TC) |

$400,000 |

$28,134,324 |

$28,534,324 |

$27,356,224 |

$126,071,943 |

TOTAL |

$100,352,380 |

$28,423,411 |

$128,775,791 |

$110,350,650 |

$367,267,668 |

Performance Metrics |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

|---|---|---|---|---|---|

Ultimate Outcome: Threats are stopped before they arrive either in Canada or the United States |

|||||

Indicator 1: Percentage of annual national security priorities on which action has been takenNote 5 |

- |

100% |

100% |

100% |

|

Intermediate Outcome 1: Canada and the United States share a common approach to effectively identify threats to either country |

|||||

Indicator 1: In consultation with U.S. law enforcement, (a) the number of priority sensor gaps identified and (b) the number of priority sensor gaps for which remedial measures have been developed (RCMP)Note 7 |

- |

(a) Technological capabilities assessed in 3 domains (land, air and maritime). (b) There were no sensor gaps identified or remedial measures developed during this reporting period. |

(a) Technological capabilities assessed in 3 domains (land, air and maritime). (b) There were no sensor gaps identified or remedial measures developed during this reporting period. |

(a) Technological capabilities assessed in 3 domains (land, air and maritime). (b) There were no sensor gaps identified or remedial measures developed during this reporting period. |

(a) Technological capabilities assessed in 3 domains (land, air and maritime). |

Indicator 2: Percentage of U.S. strategic-level operations centres connected with the Canadian Government Operations Centre (GOC)Note 9 to facilitate information flow and sharing |

100% |

100% |

100% |

100% |

100% |

Intermediate Outcome 2: Ports of entry focus on high-risk goods and individuals by expediting low-risk cargo, passenger baggage and individuals entering either country |

|||||

Indicator 1: Average passage processing time in NEXUS lanes vs. conventional lanesNote 10 |

NEXUS:

Conventional: |

NEXUS:

Conventional:

|

NEXUS: |

NEXUS: |

|

Indicator 2: Percentage of U.S. entry records successfully reconciled against a traveller record previously acquired by the CBSA (Match rate of records of entry and exit) |

- |

95% |

97. 98% |

97. 1% |

97. 7% |

Canada and the United States share a common approach to effectively identify threats to either country (Initiatives 1-4 and 7)

Initiatives 1 (Joint Threat Assessments) and 2 (Information/Intelligence Sharing):

The activities under these Initiatives began with Canada and the United States coordinating the creation of a joint inventory of existing intelligence work and completing a gap analysis. This gap analysis enhanced the collaborative process used to produce joint intelligence products. Canada and the United States have been working together through the Beyond the Border Action Plan and the collaborative day-to-day relationships that have been established between Canadian and U.S. agencies. This joint effort has enhanced our mutual understanding of each country's legal, policy, and operational frameworks governing information sharing for national security purposes. This understanding was tested by a tabletop exercise undertaken in March 2016 by Public Safety Canada and its Portfolio organizations, alongside their U.S. counterparts (including the Department of Homeland Security (DHS) and National Counter Terrorism Center (NCTC)). This exercise played an important role in strengthening knowledge about how Canadian and U.S. agencies manage ports of entry, which has helped to improve the day-to-day operational cooperation and the implementation of bilateral information sharing agreements. Initiatives 1 and 2 have concluded, with Canadian and U.S. partners agreeing that these initiatives served the purpose of elevating cooperation to the point that such standalone initiatives are no longer required.

The Government of Canada has met its commitments under Initiatives 1 and 2. All activities related to this initiative ended on March 31, 2016.

Initiative 3 (Domain Awareness):

In 2011-12, the Royal Canadian Mounted Police (RCMP), in collaboration with Canadian partners and U.S. counterparts, created a full inventory of Canadian and U.S. domain awareness capabilities at the border in order to identify gaps and vulnerabilities. A Canadian validation exercise was completed in 2012-13. In the following years, Canada and the United States have continued to develop and implement processes, procedures and policies to enable an effective, shared understanding of activities, threats and criminal trends or other consequences in the air, land and maritime environments. These goals will be achieved through intelligence analysis, effective and timely information sharing, a common understanding of the environment, and an inventory of current capabilities.

In 2015-16, the RCMP piloted a gap analysis exercise for the Quebec border region based on an existing United States Customs and Border Protection (CBP) process, which took into account all three domains. In 2016-17, once the gap analysis report has been finalized, the RCMP will meet with its respective CBP counterparts to discuss the report's findings in order to mutually address any common vulnerabilities/gaps.

Initiative 4 (Countering Violent Extremism):

Bilateral collaboration on countering violent extremism initiatives and engagement has strengthened Canada-U.S. relationships and established strong networks. Canadian and American departments have worked closely to implement the joint countering violent extremism work plan by coordinating and sharing research, best practices and tools for law enforcement and emphasizing community-based and community-driven efforts.

While the specific commitments under this initiative were met in 2013-14, Canadian federal departments continue to work with their U.S. counterparts to address this complex policy issue through other international fora, such as the Five Country Ministerial, the Global Counterterrorism Forum's Working Group on Countering Violent Extremism, and the G7 meetings on this topic.

In 2015-16, Canada continued to play a leadership role among international partners sharing different approaches, programming and strategies in countering radicalization to violence.

The Government of Canada has met its commitments under Initiative 4. Collaboration with the U.S will continue in the area of countering radicalization to violence.

Initiative 7 (Joint Food/Plant/Animal Assessments/Audits):

This initiative required the Canadian Food Inspection Agency (CFIA) and the U.S. Department of Agriculture (USDA) to work together to conduct joint assessments of plant, animal and food safety systems in third countries for the first time. This close collaboration has increased confidence in each regulatory agency's assessment processes.

With joint assessments of animal health in Colombia and Mexico; food safety in Japan and China; and the assessment of pre-departure vessel certification programs in Korea, Japan and China to reduce plant health threats, the commitments under this initiative were met in 2013-14. Both countries are confident that the continued joint assessments of animal health, plant health and food safety threats will improve the efficiency of verification activities conducted by both organizations in audits of third countries that are eligible to export to Canada and the United States.

As part of their continuing work on joint assessments, Canada and the U.S. published a report in 2014 that establishes the assessment processes and outlines the information-sharing mechanisms on the plant health risks of the Asian gypsy moth. Several recommendations in the report for program enhancements and coordination of responses to outstanding non-compliance issues with regulated countries and domestic stakeholders were implemented in 2015-16. Canada and the U.S. implemented an arrangement on zoning for Foreign Animal Disease to facilitate recognition of countries' zoning decisions during an outbreak of Foreign Animal Disease.

As well as expanding the Asian gypsy moth program in 2015-16 under the auspices of BTB, non-agricultural or forestry commodities, such as steel slabs, pipes and tiles as well as sea containers, have been identified as a potential starting point for expanded joint outreach. This will further mitigate plant health risks at origin in 2016-17 and beyond.

The Government of Canada has met its commitments under Initiative 7. Collaboration with the U.S. will continue in the area of food/plant/animal assessments/audits.

Ports of entry focus on high-risk goods and individuals by expediting low-risk cargo, passenger baggage and individuals entering either country (Initiatives 5, 6, 8-16 and 20, 22, 24)

Initiative 5 (Integrated Cargo Security):

Canada and the U.S. each formally reviewed the other's national air cargo security program and achieved mutual recognition of their respective programs which eliminated the need for re-screening of individual air cargo shipments as of March 31, 2012. This agreement was renewed in March 31, 2015 for a further three years.

Canada and the U.S. developed an Integrated Cargo Security Strategy (ICSS), a perimeter approach to inbound cargo security under the principle of "cleared once, accepted twice. " To inform the implementation of the ICSS, two pilots were launched by the Canada Border Services Agency (CBSA) and their counterparts in the United States, Customs and Border Protection (CBP), one in Prince Rupert, B. C. to examine marine-to-rail cargo and one in Montreal, Quebec looking at marine-to-truck cargo. Both pilots concluded in 2013-14 and the assessments that followed concluded that while screening for national security purposes was successfully tested, a series of operational impediments prevented either pilot from fully testing the concept of "cleared once, accepted twice" for contraband. A full assessment of these pilots can be found on the CBSA's website. Note 17

In conjunction with the ICSS pilots, Tamper Evident Technology pilots were launched in Prince Rupert and Montreal to secure cargo in-transit by applying High Security Bolt Seals (HSBS) to containers examined and released by the CBSA. The pilots demonstrated that the use of Tamper Evident Technology is an effective means of securing cargo. Moreover, they validated the security of the Asia–Pacific rail corridor for containers examined after arrival in Canada. Since the launch of the pilot, no seals were identified as being broken or tampered with upon arrival into the U.S.

A secondary component of the Tamper Evident Technology pilot was to test reusable electronic seals. To fulfill this objective, the CBSA tested electronic seals within Canada at the ports of Prince Rupert and Montreal, and subsequently in Vancouver. Electronic seals were utilized to secure containers from the marine terminals to the marine container examination facilities, allowing the CBSA to test their effectiveness domestically. Although Canada and the U.S. were unable to test electronic seals bi-nationally, both Canada and the U.S. agree that the use of tamper evident technology served to identify risk mitigated containers and provided an additional layer of security.

Additionally, CBSA and Transport Canada (TC) launched a Pre-Load Air Cargo Targeting (PACT) pilot where air cargo destined for Canada is assessed offshore for aviation and national security purposes prior to departure. After the initial pilot period where seven volunteer air carriers and two freight forwarders sent data to the PACT team prior to loading cargo onto aircraft at foreign ports, CBSA and TC agreed to extend the pilot indefinitely. To date, the results of that pilot have demonstrated that the data provided are sufficient to conduct initial risk assessments for aviation security/imminent threat purposes (e. g. explosives). The CBSA and TC are exploring opportunities to move from pilot to program in the next few years.

Work was undertaken in 2013-14 on a Wood Packaging Material (WPM) Inspections Feasibility Study. Coordinated risk assessments by the CBSA and CBP in this area would result in pre-arrival targeting and the identification of WPM shipments of interest. CBP and the CBSA, along with the U.S. Department of Agriculture (USDA) and the Canadian Food Inspection Agency (CFIA) are working to implement the WPM feasibility study's recommendations. Five recommendations were addressed in 2015-16: 1) enhanced wood-pest identification to support the inspection of WPM at the perimeter, 2) harmonizing U. S. and Canadian import policies to recognize wood packaging material in compliance with International Standards for Phytosanitary Measures (ISPM 15), 3) harmonizing U.S. and Canadian operational application of policies regarding the separation of non-compliant WPM from cargo at the marine ports of Prince Rupert, Vancouver, Montreal and Halifax, 4) exploring equivalent U.S. and Canadian monetary penalty structures for WPM compliance violations, and 5) Canada and the U.S. should pursue a more comprehensive mechanism for sharing information regarding WPM. The CBSA has revised its WPM operational policy to reflect this and the CFIA is working in collaboration with the CBSA to address the other recommendations by mid-2017.

Initiative 6 (Passenger Baggage Screening):

In February 2012 Canada began deployment of new Explosive Detection Systems equipment at its eight airports with preclearance facilities. This new technology is U.S. Transportation Security Administration (TSA) certified and as it is deployed, it enables the United States to progressively lift the requirements to re-screen passenger baggage originating from these Canadian airports. This is expected to facilitate passenger travel and result in cost savings for airports and airlines.

Since deployment began in February 2012, five of the preclearance airports have had the rescreening requirement lifted by the TSA. Two of the remaining airports have deployed the technology with the lifting of the re-screening requirement pending. The last preclearance airport is expected to deploy the technology by Fall 2016.

Initiative 8 (Electronic Travel Authorization):

Immigration, Refugees and Citizenship Canada (IRCC) began work on developing an Electronic Travel Authorization (eTA) program to improve screening for all visa-exempt foreign nationals in 2012-13. This initiative allows the Government of Canada to screen visa-exempt foreign nationals (excepting U.S. citizens) at the earliest opportunity, before they seek to board a plane to Canada, in order to determine whether or not they pose an admissibility or security risk. The cost of the eTA has been set at $7 CDN and as of August 1, 2015, prescribed travellers have been able to voluntarily complete an application on the IRCC website, and since March 15, 2016, prescribed travellers are required to hold an eTA when seeking to travel to, or enter, Canada by air. However, in order to help ensure a smooth transition to enforcement, the Government established a leniency period through September 2016, which was subsequently extended to November 9, 2016. During the leniency period, Border Services Officers could allow travellers arriving without an eTA to enter Canada, provided that they were not otherwise inadmissible.

The Government of Canada has met its commitments under Initiative 8.

Initiative 9 (Interactive Advance Passenger Information):

The Interactive Advance Passenger Information (IAPI) system was implemented in October 2015 and the onboarding of commercial air carriers to the IAPI platform began shortly thereafter. Air Canada, which represents 40% of eTA volumes, was successfully onboarded to IAPI on March 15, 2016. The IAPI system electronically validates whether travellers possess the required Immigration Refugee and Citizenship Canada (IRCC) travel documentation, including visas and electronic travel authorizations (eTA). This validation takes place prior to the boarding of international flights bound for Canada by providing commercial air carriers with a board/no-board recommendation for each traveller, and ensuring that traveller Advance Passenger Information and Passenger Name Record (API/PNR) information is received as early as 72 hours in advance to initiate the targeting and IAPI board/no-board process.

The CBSA continues to meet with the Airline Industry Working Group (AIWG) stakeholders to provide updates on the project, discuss potential impacts, and work towards resolving any issues.

Based on feedback with air industry stakeholders, the CBSA Carrier Messaging Requirements (CMR), which details the technical requirements for commercial air carriers to implement the IAPI and Entry/Exit (air mode) initiatives, was finalized and made available to air carriers as of June 2015. Of note, progress was made in the first major release, Commercial – Data Acquisition & Response (Release 1) (R121) being successfully implemented on schedule and within budget on October 22, 2015. As well, IAPI Release 1b (R290) was successfully implemented on December 17, 2015.

Initiative 10 (Immigration Information Sharing):

The Agreement between the Government of Canada and the Government of the United States of America for the Sharing of Visa and Immigration Information was signed on December 13, 2012 and came into force in 2013. That same year, Canada and the U S. launched a system for the automated exchange of immigration information using biographic-based queries (i. e. , name, date of birth, passport nationality, etc. ).

In 2015, Canada and the U.S. successfully launched an automated biometric-based (fingerprint) query capability. Canada now sends the U.S. biographic-based queries on all temporary and permanent resident applicants, and biometric-based queries on all immigration applications for which biometrics are required.

The benefits to Canada of these information sharing activities are clear: U.S. data assists Canadian officials in verifying applicants' identities; uncovers previously unknown immigration information; and facilitates the travel of individuals who are identified as low-risk.

The Government of Canada has met its commitments under Initiative 10. Both biographic-based and biometric-based immigration information sharing capabilities have been implemented with the U.S.

Initiative 11 (Entry/Exit Information System):

The Entry/Exit initiative establishes coordinated entry and exit information systems between Canada and the U.S. to exchange biographic information (e. g. name, citizenship) on third-country nationals and permanent residents, such that a record of entry into one country constitutes a record of exit from the other.

During the 2015-16 reporting period, virtually all (97. 7%) U.S. entry records (exits from Canada) were successfully reconciled to an entry record previously collected by the CBSA. Entry/Exit continues to allow for the CBSA to close outstanding immigration warrants and reprioritize ongoing investigations for persons identified as having departed Canada.

On March 10, 2016, Canada's Prime Minister and the United States President reaffirmed the commitment to a coordinated entry and exit information system, and pledged to build upon the process already in place.

The CBSA, in partnership with the IRCC continues to work toward system readiness for the inclusion of citizens, as well as all travellers in the air mode. Enabling legislative and regulatory authorities must be in place before full implementation can be achieved.

Theme 2: Initiatives 12-24

Trade Facilitation, Economic Growth and Jobs

The free flow of goods and services between Canada and the United States creates significant economic benefits for both countries. As the two countries work to strengthen the security of the shared perimeter, initiatives to create more openness at the land border for legitimate travel and trade are being pursued under the BTB Action Plan.

Enhancing the benefits of programs that help trusted businesses and travellers move efficiently across the border is a key element of this approach. This is being achieved through adopting a common framework for trusted trader programs that aligns requirements, enhances member benefits and provides applicants with the opportunity to submit one application to multiple programs, and by increasing harmonized benefits to NEXUS members. Enhancing the facilities that support these trusted traveller and trader programs is also key to achieving this goal.

Expanding beyond existing programs and developing additional initiatives for expediting legitimate travellers and cargo increases the economic benefits to Canada and the United States. Expanding preclearance to all modes of travel will give more travellers and traders access to these services and will expedite cross-border travel and business. Providing a single window through which importers can electronically submit all information to comply with customs and other participating government agency regulations aims to eliminate duplicate processes at the border and provide consistent application of Canada's commercial import reporting requirements. Harmonizing the Canadian and American low-value shipment processes expedites customs administration.

Investment in improving shared border infrastructure and technology ensures that benefits last for years. Coordinating border infrastructure investment and upgrades to physical infrastructure at key border crossings and at small and remote ports of entry ensures maximum investment benefit. This includes implementing a border wait-time measurement system at mutually determined high-priority Canada-United States border crossings, facilitating secure passage and expediting processing through implementing Radio Frequency Identification technology at appropriate crossings and enhancing bi-national port operation committees.

OutcomesNote 18

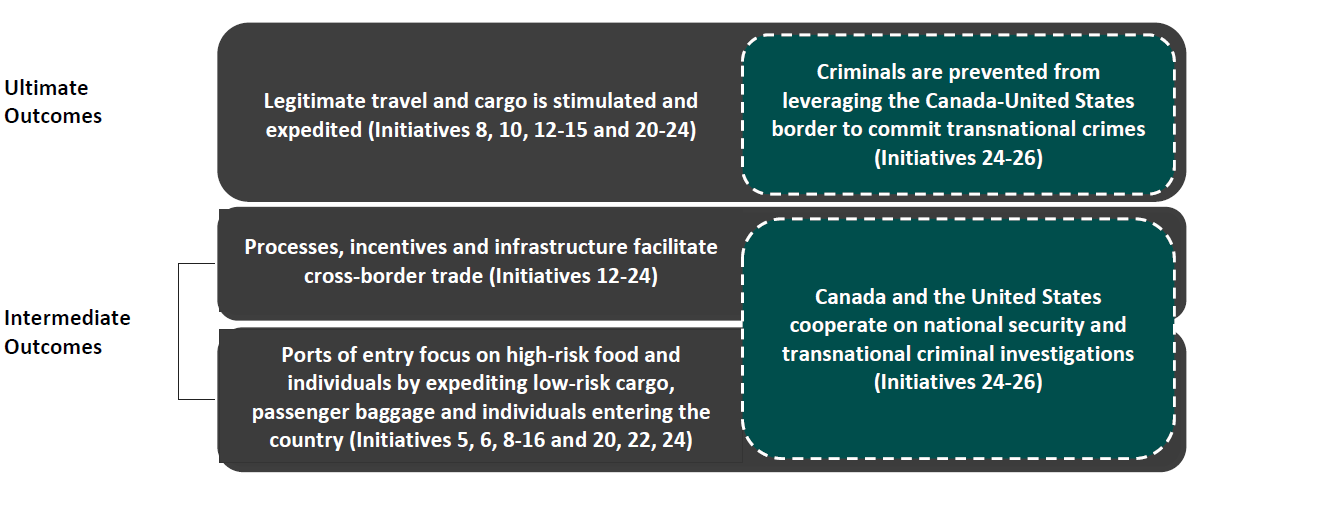

Image description

This image illustrates the outcomes of Theme 2 of the Beyond the Border Action Plan. This theme is called Trade Facilitation, Economic Growth and Jobs. This figure demonstrates the linkages between the Intermediate Outcomes and the Ultimate Outcomes for Theme 2. The outcomes are also linked to specific Beyond the Border Action Plan initiatives.

The Intermediate Outcomes for Theme 2 are:

Ports of entry focus on high-risk goods and individuals by expediting low-risk cargo, passenger baggage and individuals entering the country (Initiatives 5, 6, 8-16 and 20, 22, 24).

Processes, incentives and infrastructure facilitate cross-border trade (Initiatives 12 -24).

Also, in dotted lines is an outcome stating that Canada and the United States cooperate on national security and transnational criminal investigations (Initiatives 24-26). This is an intermediate outcome which is shared between Theme 2 and Theme 3. Theme 3 is called Cross-Border Law Enforcement.

The Ultimate Outcomes for Theme 2 are:

Legitimate travel and cargo is stimulated and expedited (Initiatives 8, 10, 12-15 and 20-24)

Also, in dotted lines is an outcome stating that Criminals are prevented from leveraging the Canada-United States border to commit transnational crimes (Initiatives 24-26). This is an intermediate outcome which is shared between Theme 2 and Theme 3.

Department/Agency |

2015-16 (in dollars) |

Cumulative Actual Spending to Date (2012-2016) |

||||

|---|---|---|---|---|---|---|

New Funding |

Internal Reallocation |

Total Planned Spending |

Actual Spending |

|||

Canada Border Services Agency (CBSA) |

$57,604,160 |

$0 |

$57,604,160 |

$31,411,972 |

$91,163,519Note vii |

|

Canadian Food Inspection Agency (CFIA) |

$2,040,000 |

$0 |

$2,040,000 |

$2,392,700 |

$8,619,770 |

|

Canadian Nuclear Safety Commission (CNSC) |

$950,000 |

$0 |

$950,000 |

$887,241 |

$1,394,401 |

|

Global Affairs Canada (GAC) |

$300,000 |

$7,444,209 |

$7,744,209 |

$11,664,602 |

$25,842,918Note viii |

|

Department of Fisheries & Oceans (DFO) |

$350,000 |

$0 |

$350,000 |

$207,856 |

$585,381Note ix |

|

Environment and Climate Change Canada (ECCC) |

$1,687,635 |

$0 |

$1,687,635 |

$982,900 |

$3,670,258Note x |

|

Federal Bridge Corporation Limited (FBCL) |

$18,250,000 |

$0 |

$18,250,000 |

$10,301,501 |

$11,622,598Note xi |

|

Health Canada (HC) |

$1,480,000 |

$0 |

$1,480,000 |

$1,296,726 |

$9,543,955 |

|

Natural Resources Canada (NRCan) |

$960,000 |

$0 |

$960,000 |

$960,001 |

$3,035,041 |

|

Public Health Agency of Canada (PHAC) |

$1,006,560 |

$0 |

$1,006,560 |

$576,824 |

$2,086,835Note xii |

|

Public Safety Canada (PS) |

$0 |

$469,058 |

$469,058 |

$666,145 |

$3,176,447Note xiii |

|

Transport Canada (TC) |

$8,081,377 |

$797,163 |

$8,878,540 |

$1,349,833 |

$5,186,041Note xiv |

|

TOTAL |

$92,709,732 |

$8,710,430 |

$101,420,162 |

$62,698,301 |

$165,927,164 |

|

Performance Metrics |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

|---|---|---|---|---|---|

Ultimate Outcome: Legitimate travel and cargo are stimulated and expedited |

|||||

Indicator 1: Percentage of border wait-time standards that are achievedNote 19 |

98. 3%Note 22 |

97. 4% |

97. 2% |

||

Indicator 2: Value for Duty (VFD)Note 23 of Trusted Trader (TT) members (CSA/PIP)Note 24 as a percentage of total commercial VFDNote 25 |

27. 0% |

27. 4% |

29. 0% |

31. 5% |

|

Indicator 3: Number of NEXUS Lanes at Canadian Ports of Entry |

22 |

28 |

33 |

33 |

36 |

Intermediate Outcome : Processes, incentives and infrastructure facilitate cross-border trade |

|||||

Indicator 1: Number of new Trusted Trader (CSA/PIP) MembershipsNote 27 |

N/A |

197 |

155 |

156 |

163 |

Indicator 2: Ratio of regular commercial (non-Trusted Trader) examination rate compared to Trusted Trader examination rateNote 28 |

- |

3. 6 to 1 |

3. 5 to 1 |

2. 8 to 1 |

2. 1 to 1 |

Indicator 3: Number of (a) new applications and (b) percentage change in the number of members for:

|

CDRP: FAST: |

CDRP: FAST: |

CDRP: FAST: |

CDRP: FAST: |

CDRP: FAST: |

Indicator 4: Trusted Trader (CSA/PIP) imports as a percentage of total commercial imports (i. e. commercial releases)Note 30 |

N/A |

13. 5% |

13. 8% |

13. 6% |

13. 9% |

Intermediate Outcome : Ports of Entry focus on high risk goods and individuals by expediting low-risk cargo, passenger baggage and individuals entering either country |

|||||

Indicator 1: Average passage processing time (from RFID capture to BSO decision in land mode) in NEXUS lanes vs. conventional lanes (by conveyance) |

NEXUS:

Conventional: |

NEXUS:

Conventional:

|

NEXUS:

Conventional: |

NEXUS: |

NEXUS: |

Indicator 2: Number of (a) new applications and (b) percentage change in the number of members for NEXUS |

NEXUS: |

NEXUS: |

NEXUS: |

NEXUS: |

NEXUS: |

Indicator 3: Number of total shipments processed under expedited customs clearance (i. e. Low-Value Shipments) |

34,802,654 |

34,606,543 |

37,528,815Note 39 |

39,082,146 |

39,121,934 |

Indicator 4: Performance in processing low-value shipments on the same day as they arrive in Canada |

-- |

-- |

98% |

98% |

99% |

Ports of entry focus on high risk goods and individuals by expediting low-risk cargo, passenger baggage and individuals entering either country (Initiatives 5, 6, 8-16 and 20, 22, 24)

Initiative 12 (Enhancing Benefits for Trusted Trader Programs):

The BTB Action Plan committed Canada and the U.S. to aligning and enhancing the benefits of both the Tier I and Tier II Trusted Trader programs to further facilitate the cross-border movement of low-risk trade and reduce the costs of compliance with customs requirements.

The Canada Border Services Agency (CBSA) and their U.S. counterparts at Customs and Border Protection (CBP) began work on this initiative by conducting detailed comparisons of both tiers of the Canadian and American Trusted Trader programs to identify opportunities to harmonize eligibility criteria, program requirements and operational policies and procedures.

The CBSA and CBP began the Tier I harmonization of Canada's Partners in Protection (PIP) and the U.S.'s Customs-Trade Partnership Against Terrorism (C-TPAT) programs in 2013-14 by allowing applicants to apply to both programs using a single process. Implementation of this process began with highway carriers and work continues. To further simplify the PIP process in Canada, in June 2014 the CBSA launched a new online Trusted Trader Portal that allows companies to apply for PIP membership and existing members to maintain their Trusted Trader membership.

Canada's Customs Self-Assessment (CSA) program and the U.S.'s Importer Self-Assessment (ISA) program make up Tier II where the emphasis is on trade compliance and expedited border and accounting processes. A Joint Stakeholder Consultation Report was published in December 2013 in which the CSA and ISA programs were compared. Canada also expanded the CSA program to allow "non-resident" importers to participate.

A number of pilots have been launched since the beginning of the Action Plan to expedite low-risk cargo crossing to the Canada-U.S. border. The CFIA and the CBSA completed a pilot in July 2012 which assessed the feasibility of allowing non-federally registered food products such as cereals, granola bars, and chocolate chips to be eligible for the CSA program. The two agencies carried out another pilot project in 2013-14 with a major food importing company to test the feasibility of allowing the importation of selected low-risk processed, pre-packaged foods from the U.S. into Canada under the CSA program. Phase II of that pilot began in 2014-15; however, regulatory changes that impacted the CFIA's requirements on the importation of foods, delayed consultations.

The Free and Secure Trade (FAST) Expansion Pilot was completed in April 2013. It evaluated the impact of expanding FAST benefits to organizations listed under the PIP program and to CSA members. This pilot also collected baseline data through Radio Frequency Identification technology (RFID). Canada continues to work towards the expansion of Free and Secure Trade (FAST) benefits for trusted trader partners.

In 2015-16, the CBSA and the CFIA met to discuss possible options that would allow the importation of other government departmental (OGD) goods from the U.S. into Canada under the CSA program. No mutually satisfactory solution was found. During 2015, the CBSA explored many options for IT system changes that are necessary for expedited front line processing to support this initiative. Following extensive analysis and consultation, recommendations to expand FAST benefits, including infrastructure, were finalized and are expected to be published on the CBSA website in the Winter 2016. Detailed plans were also developed for FAST lane expansion/modification at three high-volume commercial ports of entry.

Initiative 13 (Increasing Harmonized Benefits to NEXUS Members):

As part of a trusted traveller program, NEXUS members are pre-approved as low-risk travelers who enjoy the benefit of expedited travel. This initiative was designed to increase and retain membership in the NEXUS program to support strategic management of the border, by enabling resources at ports of entry to be focused more on unknown or higher-risk individuals and less on members of NEXUS.

Increasing NEXUS membership has been very successful. The program reached the one million member milestone in July 2014 and as of December 2015, there were 1. 3 million NEXUS members. In 2015, of the roughly 64 million overall travelers crossing the Canada-U.S. land border, approximately 6. 6 million took advantage of NEXUS lanes – accounting for about 12% of all traveler crossings and some 15% of all vehicle crossings. To respond to increased demand for NEXUS membership, since 2012 both the CBSA and U.S. Customs and Border Protection have regularly held enrolment blitzes to reduce wait times for applicants.

Benefits for NEXUS members have expanded under this initiative, and the U.S. now recognizes NEXUS membership for Trusted Traveller lines at pre-board screening checkpoints for flights from Canada to the U.S. The number of Canadian airports with designated Trusted Traveller lines, or that have dedicated entrances that allow NEXUS members to proceed directly to the front of the screening line, have increased. Additionally, Canadian NEXUS members are now eligible to participate in the U.S. TSA's Pre✓™program. Members can use this program when booking flights on participating airlines departing from participating airports within the U.S. and to select international destinations. The Canadian Air Transport Security Authority (CATSA) has adopted some of the TSA's Pre✓™ program practices at three of Canada's busiest airports (Vancouver, Toronto-Pearson Terminals 1 and 3, and Montreal) in order to allow NEXUS members to have access to faster security screening.

At the North American Leaders Summit (NALS) in February 2014, it was announced that Canada, the U.S. and Mexico would establish a North American Trusted Traveller Program, beginning with the mutual recognition of the NEXUS, Global Entry, SENTRI and Viajero Confiable programs. In July 2015, Public Safety Canada, the U.S. Department of Homeland Security and Mexico's Secretariat of the Interior signed a Memorandum of Understanding towards a Trilateral Trusted Traveler Arrangement that expands the pool of applicants who can apply for Trusted Traveler Programs.

Processes, incentives and infrastructure facilitate cross-border trade (Initiatives 14-24)

Initiative 14 (Enhancing Facilities to Support Trusted Trader and Traveller Programs):

In 2012-13, the CBSA implemented five NEXUS lanes, three in British Columbia (Pacific Highway, Douglas and Abbotsford) and two in Ontario (Sarnia and Fort Erie). In July 2015, an additional NEXUS flex lane opened at the Derby Line-Stanstead border crossing, providing more efficient border clearance for low-risk travelers. CBSA also installed a "NEXUS 9" lane in Aldergrove, British Columbia, bringing the total number of additional NEXUS lanes installed to 14, which completed the trusted traveller component of the enhanced facilities initiative.

During 2013-14, the closing report on the Free and Secure Trade (FAST) Sarnia pilot determined that there would be no negative impact on existing FAST lane users by expanding FAST benefits to Partners in Protection (PIP)-only and Customs Self Assessment (CSA)-only programs. The CBSA then developed a FAST Recommendation Report in 2014 that recommended FAST lane and booth expansion/modification in Fort Erie, Ontario; at the Pacific Highway, British Columbia; and in Emerson, Manitoba. Funding was approved in June 2015 and the project team developed a project charter and project management plan, as well as detailed business requirements for each expansion site.

Initiative 15 (Pre-Inspection and Preclearance):

On March 14, 2013, Canada and the United States signed a Memorandum of Understanding for a two-phased truck cargo pre-inspection pilot project on Canadian soil. Phase I of the project at the Pacific Highway crossing in Surrey, British Columbia concluded in November 2013. Phase II launched in February 2014 at the Peace Bridge crossing between Fort Erie, Ontario and Buffalo, New York and concluded in January 2015. The pilot resulted in valuable lessons learned for the U.S. CBP in relation to technological improvements and initiatives to facilitate crossing at the U.S. border.

Negotiations on a comprehensive preclearance approach for all modes of cross-border trade and travel were finalized in 2014-15 and the Agreement on Land, Rail, Marine and Air Transport Preclearance (LRMA) was signed on March 16, 2015. A year later, Canada and the U.S. signed a Joint Statement of Intent (LRMA) which included a commitment to move forward with the implementation of the Agreement and an agreement-in-principle to expand preclearance in Canada to Billy Bishop Toronto City Airport, Québec City Jean Lesage International Airport, Montréal train station and Rocky Mountaineer train service in Vancouver. Canada's legislation to implement the LRMA is expected to be introduced in Parliament in 2016. Passage of the bill and regulations will be required before the LRMA can come into effect. Canadian and U.S. officials continue to work together, and with stakeholders, to prepare for implementation of the LRMA and potential expansion to new sites/modes for travellers as well as the potential for cargo preclearance or pre-inspection.

The Government of Canada has met its commitments under Initiative 15.

Initiative 16 (Facilitating the Conduct of Cross-Border Business):

Under the Action Plan, Canada and the United States committed to specific measures to facilitate the conduct of cross-border business and to propose options for regular stakeholder engagement on cross-border business travel. The Government of Canada met its commitments in 2013-14 through the training of front-line officers to improve the consistency of border determinations, changes to the NEXUS client profile to allow for the incorporation of work permit information, and changes to existing rules authorizing temporary entry of business visitors who provide after-sale service.

Though it has met its commitments, the Government of Canada continues to explore opportunities with the United States with respect to cross-border business travel facilitation.

The Government of Canada has met its commitments under Initiative 16.

Initiative 17 (Single Window):

The Single Window Initiative (SWI) is a CBSA-led project which provides a single window through which importers can electronically submit all information to comply with customs and other Participating Government Departments and Agencies (PGAs) regulations. The SWI aims to eliminate redundant processes at the border and provide consistent application of Government of Canada's commercial import reporting requirements. It also aligns with international standards and enhances government service delivery for the trade community through simplified border processing.

As of 2015-16, the SWI was in year five of a five-year capability development project. The SWI went live on March 29, 2015. Since that time, CBSA has incorporated 7 of the 9 PGAs encompassing 28 of the 38 programs which are in production. The remaining PGAs, Fisheries and Oceans Canada (DFO) and the Canadian Nuclear Safety Commission (CNSC), and their programs are to follow by December 2016. As of March 2016, the SWI replaced 85% of all licenses, permits and certificates and other import documentation (LPCO) of the 38 programs in paper forms with electronic references. The conversion of all LPCOs will be complete by April 2017. Additionally, the SWI project achieved 96% of data elements of Canada's Integrated Import Declaration (IID) in alignment with the U.S. , making U.S. and Canada trade more efficient.

As the use of the IID is voluntary for commercial importers and brokers, the CBSA is actively conducting stakeholder engagement sessions with Trade Chain Partners (TCP) and industry stakeholders to increase the uptake and realize the expected benefits of the SWI. The CBSA SWI will continue working on providing enhancements to functionality, further onboarding of programs, certification of Trade Chain Partners, implementation of outreach improvements and integration within the Commercial System enhancements under eManifest.

Initiative 18 (Harmonizing Low Value Shipment Thresholds):

On January 8, 2013 the CBSA and CBP concurrently increased their low-value shipment thresholds to $2,500 from the existing level of $1,600 in Canada and $2,000 in the United States. Canada also increased the low-value shipment threshold to $2,500 for exemption from NAFTA Certificate of Origin requirements, aligning it with the threshold of the U.S.

In 2015-16, the CBSA processed 99% of all low-value shipments on the same day of arrival. Due to the nature of the program, all goods which are not seized after examination or found to be ineligible for release under the program are processed on the same day. This percentage has remained consistent since the inception of the Courier Low-Value Shipment (CLVS) Program in 1993 in spite of the increased volume of shipments. In order to continue meeting commitments in the face of exponential volume growth, the CBSA is undertaking the development of an e-Commerce Strategy in support of efforts to modernize the CLVS program and will continue to collaborate with U.S. CBP and other Border Five (B5) partners.

The Government of Canada has met its commitments under Initiative 18 and is continuing to strengthen its approach.

Initiative 19 (Accountability for Border Fees/Charges):

To bring greater public transparency and accountability to the application of border fees and charges, CanadianNote 40 and AmericanNote 41 border fee inventories were developed and posted online in December 2013. These inventories set out the purpose and legal basis of these fees and charges, how they are collected, how much is collected, their intended use, and the rationale for collecting them at the border. They include fees that are applied to the entry of goods into the country, mandatory to each and every shipment, established by legal authority (a law, regulation or statutory authority), and administered by a department or agency of either federal government.

In 2013-14, a third party contractor was commissioned to conduct an economic impact assessment of border fees. The assessment focused on the economic impact of border fees and charges included in the inventories on motor vehicle and motor vehicle parts manufacturing, as well as vegetable and melon farming industries in Canada and the United States. This assessment concluded in 2014-15 and the executive summary was published on the Public Safety Canada websiteNote 42 on April 7, 2016, with the full study available upon request. Overall, the study's results indicate that the border fees in the inventories analyzed make up a small component of the overall cost of crossing the Canada-U.S. border for the private sector. The report also noted that structural differences in how fees are applied can lead to differences in their effects, with the results indicating that fees have a greater impact on industries in Canada.

The publication of this assessment completed the Government of Canada's commitment under this initiative.

The Government of Canada has met its commitments under Initiative 19.

Initiative 20 (Expanding and Upgrading Infrastructure at Key Crossings):

In Spring 2013, the Government of Canada announced up to $127 million in funding to expand and modernize facilities at the ports of entry in Lacolle, Quebec; Lansdowne, Ontario; Emerson Manitoba; and North Portal, Saskatchewan. These were identified as initial priority border crossings in the first ever bi-national Border Infrastructure Investment Plan and these improvements will increase capacity for commercial traffic, reduce wait times and strengthen border security. Upgrades and improvements to the Lansdowne, Emerson, and North Portal ports of entry are underway and the projects are expected to be completed in 2017-18. The upgrade to the Lacolle port of entry is expected to be completed in 2018-19.

Initiative 21 (Coordinating Investments at Small and Remote Ports of Entry):

In 2012-13, the Canada-U.S. Small Ports Working Group was established and identified 62 ports of entry (POE) for consideration under this initiative. Additionally, a Work Plan for the Development of the Small and Remote Ports Joint Action Plan was included as part of the inaugural Border Infrastructure Investment Plan.

In 2013-14, the CBSA announced plans to pilot remote traveler processing starting in April 2015 at two locations: Piney, Manitoba and Morses Line, Quebec. The objectives of the pilot are to test the viability and potential benefits of implementing remote traveller processing at select small and remote POEs as a way to increase efficiency, while maintaining border integrity and access to needed border services. In 2014-15, a simulation of the remote traveler processing concept of operations, including supporting infrastructure, technological, policy and program components was developed, tested and refined for implementation.

During 2015-2016, the CBSA and U.S. CBP continued to consider opportunities for alignment of hours of service and potential co-location. The CBSA finalized the development of a remote traveller processing (RTP) solution and launched the pilot at Morses Line, Quebec, on January 18, 2016. Since the launch, traveller volumes at the Morses Line crossing have increased by 19. 5% as a result of the enhanced client service.

Initiative 22 (Deploying Border Wait-Time Technology and Establishing Wait-Time Service Levels):

Both Canada and the U.S. published service level standards on their respective CBSA and CBP websites by the Action Plan mandated date of June 2012.

Canada and the U.S. committed to implementing border wait-time (BWT) measurement systems at 20 high-priority border crossings. These systems have been implemented at seven crossings (four in British Columbia and three in Ontario). Funding has been identified in Canada for the deployment of BWT measurement technology for the remaining 13 high-priority border crossings; however, no new BWT system was installed in 2015-2016.

In 2015, the U.S. Department of Transportation (DOT)-Federal Highway Administration (FHWA) launched an application process for a pilot initiative that would accelerate the adoption of innovative technology to measure delays and border wait times at the land border ports of entry identified in the Beyond the Border Action Plan. Following this application process, the U.S. DOT-FHWA planned to announce funding for successful applicants in summer 2016. Additionally, Transport Canada is awaiting the results of work being undertaken by U.S. CBP regarding its data-driven pilot project approach as a potential border wait-time measurement solution.

Initiative 23 (Installing Radio Frequency Identification (RFID) Technology):

Canada committed to the installation of RFID technology in two conventional passenger lanes at 11 ports of entry (total of 22 lanes) to align with existing American investments and to expedite traveler processing and contribute to reducing border wait times.

During 2015-16, the CBSA awarded the procurement contract for the purchase and installation of the RFID readers. With the contract in place, system changes to integrate the RFID hardware were completed and preparation began for the construction required for infrastructure upgrades to prepare lanes for the installation of RFID technology. In addition, existing Memoranda of Understanding (MOU) with provinces were amended to allow the CBSA to access the Enhanced Driver's License (EDL) database.

The CBSA will further advance this project over the coming year by completing the construction and installation of the RFID readers, and ensuring the CBSA can access RFID-enabled documents at the border.

Initiative 24 (Organizing Bi-National Port Operations Committees):

Eight Bi-National Port Operations Committees (BPOCs) were established in early 2012 at each of the Canadian airports that provide U.S. preclearance, in addition to the 20 BPOCs established in 2011 at land border ports of entry. BPOCs were put into place to ensure cooperation and partnering to enhance collaboration on overall port management, coordinate emergency response and preparedness, integrate enforcement efforts, and to improve the efficiency of the mitigation strategies for border wait times.

These individual BPOCs completed their Actions Plans by March 31, 2012 and report excellent communication and cooperation in all their joint engagements. Where partnerships are practical and permissible under current legislation, joint standard operating procedures have been written.

During 2015-16, the BPOCs continued their efforts in advancing work to support the joint initiatives and an exercise was undertaken between the CBSA and their CBP counterparts to identify inefficiencies at the border while proposing solutions and recommendations on how these could be improved.

Each of the 28 BPOCs will continue to meet as needed while moving forward with their individual deliverables.

The Government of Canada has met its commitments under Initiative 24. Each of the 28 BPOCs will continue to meet at least four times per year while also implementing their individual action plans.

Theme 3: Initiatives 25 and 26

Cross-Border Law Enforcement

Canada and the United States have developed successful models for preventing criminals from crossing the border to escape justice; the work under this theme deepens those efforts. By cooperating on investigations and prosecutions, both countries enjoy increased security. Further cooperation on national security and transnational criminal investigations, and providing interoperable radio capability to law enforcement actors builds on existing cooperative law enforcement programs.

Outcomes

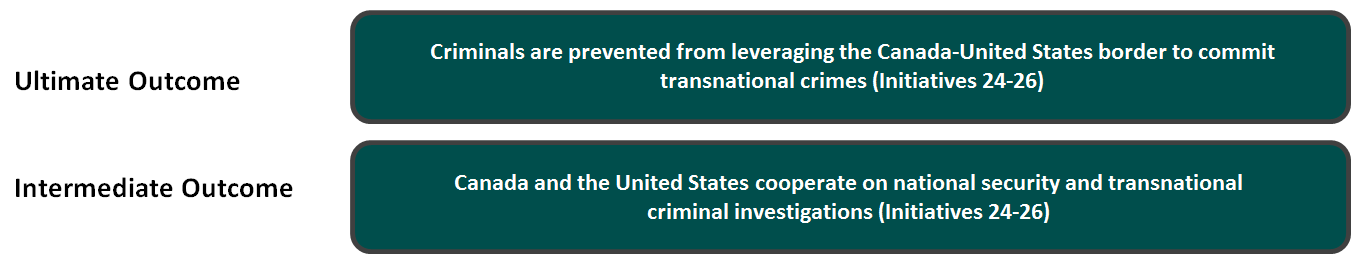

Image description

This image illustrates the outcomes of Theme 3 of the Beyond the Border Action Plan. This theme is called Cross-Border Law Enforcement. This figure demonstrates the linkages between the Intermediate Outcome and the Ultimate Outcome for Theme 3. The outcomes are also linked to specific Beyond the Border Action Plan initiatives.

The Intermediate Outcome is Canada and the United States cooperate on national security and transnational criminal investigations (Initiatives 24-26).

The Ultimate Outcome is Criminals are prevented from leveraging the Canada - United States border to commit transnational crimes (Initiatives 24-26).

Department/Agency |

2015-16 (in dollars) |

Cumulative Actual Spending to Date (2012-2016) |

|||

|---|---|---|---|---|---|

New Funding |

Internal Reallocation |

Total Planned Spending |

Actual Spending |

||

Public Prosecution Service of Canada (PPSC) |

$1,100,000 |

$0 |

$1,100,000 |

$115,211 |

$790,831Note xv |

Public Safety Canada (PS) |

$0 |

$219,272 |

$219,272 |

$182,815 |

$843,717Note xvi |

Canada Border Services Agency (CBSA) |

$0 |

$0 |

$0 |

$0 |

$41,585 |

Royal Canadian Mounted Police (RCMP) |

$21,438,678 |

$252,165 |

$21,690,843 |

$9,681,355 |

$27,143,837Note xvii |

TOTAL |

$22,538,678 |

$471,437 |

$23,010,115 |

$9,979,381 |

$28,810,970 |

Performance Metrics |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

|---|---|---|---|---|---|

Ultimate Outcome: Criminals are prevented from leveraging the Canada-U. S. Border to commit transnational crimes |

|||||

Indicator 1: Percentage of border covered by radio interoperability systems |

14. 3%Note 44 |

28. 6%Note 45 |

28. 6% |

28. 6% |

|

Indicator 2: Number of kilometres of the shared Canada-U. S. maritime border which are covered by Shiprider operations |

- |

718 kmNote 47 |

718 km |

1,068 kmNote 48 |

|

Indicator 3: Number of arrests and seizures as a result of Shiprider and Next Generation operations |

- |

1 Canadian Criminal Code Charge |

14 Canadian Criminal Code Charges |

0 Canadian Criminal Code ChargeNote 50 |

|

Intermediate Outcome: Canada and the U. S. cooperate on national security and transnational criminal investigations |

|||||

Indicator 1: Number of Canadian officers who have completed training for Shiprider and Next Generation operations during the fiscal year |

21 |

14 |

14 |

21 |

22 |

Indicator 2: Number of officers who are cross-designated for Shiprider and Next Generation operations |

66 |

83 |

84 |

106 |

|

Indicator 3: Number of regularized Shiprider teams deployed |

2 |

2 |

2 |

4 |

|

Indicator 4: Total hours of Shiprider Patrols |

- |

300 |

1700 |

1466. 75Note 54 |

|

Indicator 5: Number of Shiprider boardings of Canadian & U.S. vessels |

- |

105 |

520 |

501 |

|

Canada and the United States cooperate on national security and transnational criminal investigations (Initiatives 25-26)

Initiative 25 (Pursuing National Security and Transnational Criminal Investigations – Shiprider/Next Generation):

Shiprider

Through the Shiprider initiative, which involves vessels jointly crewed by specially-trained and designated Canadian and U.S. law enforcement officers, Shiprider officers have been actively enforcing laws and regulations on shared waterways. In June 2012, the Integrated Cross-Border Maritime Law Enforcement Operations Act, enacted to implement the Shiprider Framework Agreement, received Royal Assent. The Framework Agreement came into force in August 2012. Shiprider operations were regularized in B. C/Washington and Windsor/Detroit in June 2013. In 2015-16, two other Shiprider operational units were regularized in Kingston and in Niagara.

There are currently over 120 Canadian officers cross-designated for Shiprider operations and in 2015-16, over 1400 patrol hours were conducted and approximately 500 vessels were boarded during Shiprider operations. In addition to enforcing laws and regulations (including the Customs Act, Criminal Code, Canada Shipping Act, and Excise Act), there were five arrests made and four seizures of illegal contraband.

Next Generation

The Beyond the Border Action Plan also called for the implementation of the "Next Generation" pilot projects to create integrated teams in areas such as intelligence and criminal investigations, drawing on the Shiprider model and other successful cooperative approaches. This initiative has been suspended because the legislative framework in both Canada and the U.S. inhibits the implementation as envisioned. However, Canada and the U.S. continue to examine cross-border law enforcement cooperation through working groups, high-level fora, and regular dialogue.

Initiative 26 (Radio Interoperability):

A bi-national radio interoperability system between Canadian and U.S. border enforcement personnel was introduced to permit law enforcement agencies to coordinate effective bi-national investigations, to allow for timely responses to border incidents, and to improve both officer and public safety.

In 2012-13, Washington/Vancouver, one of the eight interconnect dispatch locations on both sides of the Canada-U.S. border, was successfully connected to increase "between the ports" communication. In 2013-14, the Detroit/Windsor location was connected and the total number of locations to be connected was reduced from eight to seven because there is no U.S. Customs and Border Protection sector along the Alaska/Yukon border. The remaining five regions in Canada are ready to be connected and one of them is expected to have full connectivity with its U.S. counterparts in 2016-17.

Theme 4: Initiatives 27-32

Critical Infrastructure and Cyber Security

Canada and the United States are connected by critical infrastructure — from bridges and roads to energy infrastructure and cyberspace. Cyber security incidents often do not respect international borders, and thus require robust operational cooperation between countries. Therefore, enhancing the resiliency of our shared critical and cyber infrastructure is key to our mutual security.

This involves executing programs and developing joint products to enhance cross-border critical infrastructure protection and resilience, as well as expanding joint leadership on international cyber-security efforts. Domestically, protecting vital government and critical digital infrastructure of bi-national importance and making cyberspace safer for all our citizens enhances our resilience.

Beyond increasing our resiliency, the Action Plan addressed the need to be able to rapidly respond to, and recover from, disasters and emergencies on either side of the border. This includes mitigating the impacts of disruptions on communities and the economy by managing traffic at affected border crossings in the event of an emergency. Also important is our work to enhance our collective preparedness and response capacity for health security threats. As well, we are working together to establish bi-national plans and capabilities for emergency management, with a focus on chemical, biological, radiological, nuclear and explosives (CBRNE) events.

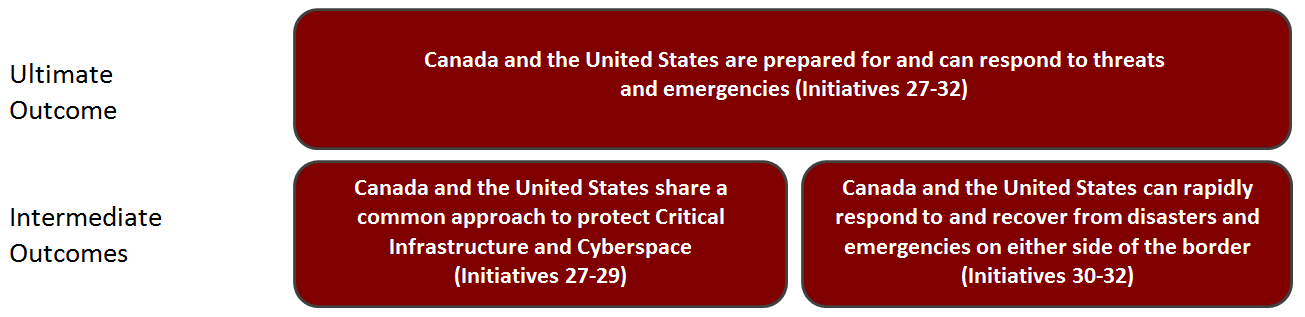

Outcomes

Image description

This image illustrates the outcomes of Theme 4 of the Beyond the Border Action Plan. This theme is called Critical Infrastructure and Cyber Security. This figure demonstrates the linkages between the Intermediate Outcomes and the Ultimate Outcome for Theme 4. The outcomes are also linked to specific Beyond the Border Action Plan initiatives.

The Intermediate Outcomes for Theme 4 are:

Canada and the United States share a common approach to protect Critical Infrastructure and Cyberspace (Initiatives 27-29).

Canada and the United States can rapidly respond to and recover from disasters and emergencies on either side of the border (Initiatives 30-32).

The Ultimate Outcome is Canada and the United States are prepared for and can respond to threats and emergencies (Initiatives 27-32).

Department/Agency |

2015-16 (in dollars) |

Cumulative Actual Spending to Date (2012-2016) |

|||

|---|---|---|---|---|---|

New Funding |

Internal Reallocation |

Total Planned Spending |

Actual Spending |

||

Canada Border Services Agency (CBSA) |

$0 |

$33,000 |

$33,000 |

$30,000 |

$389,375Note xviii |

Public Safety Canada (PS) |

$2,609,006 |

$0 |

$2,609,006 |

$2,844,702 |

$12,595,214Note xix |

Transport Canada (TC) |

$0 |

$0 |

$0 |

$226,745 |

$532,356Note xx |

TOTAL |

$2,609,006 |

$33,000 |

$2,642,006 |

$3,101,447 |

$13,516,945 |

Performance Metrics |

2011-12 |

2012-13 |

2013-14 |

2014-15 |

2015-16 |

|---|---|---|---|---|---|

Ultimate Outcome: Canada and the United States are prepared for and can respond to threats and emergencies |

|||||

Indicator 1: Critical Infrastructure Resilience ScoreNote 56 |

- |

51. 91 |

33. 98 |

36. 43 |

|

Intermediate Outcome: Canada and the United States share a common approach to protect Critical Infrastructure and Cyberspace |

|||||

Indicator 1: Percentage of stakeholders that have taken risk management action following site assessment |

To be measured in 2016-17 |

||||

Indicator 2: Number of training sessions conducted through Initiative 27 - Enhancing Cross-Border Critical Infrastructure and Resilience |

4 |

5 |

8 |

2 |

3 |

Indicator 3: Percentage of critical infrastructure sectors represented at the National Cross Sector Forum |

100% |

100% |

100% |

100% |

100% |