Public Safety Canada 2021-22 Departmental Financial Situation

Main Estimates 2021-22

The Department manages two (2) voted appropriations:

Vote 1 – Operating Expenditures ($181.3 million):

- Main Estimates have increased by 47.2% over the last five years (from $123.2 million in 2017-18 to $181.3 million in 2021-22). The increase is exacerbated due to the addition of $32.3M for the relocation and accommodations for the Government Operations Center.

- Personnel expenditures represent 1,200 FTEs, as per the Departmental Plan.

Vote 5 – Grants & Contributions ($858.2 million):

- Main Estimates have decreased by 6.2% over the last five years (from $914.5 million in 2017-18 to $858.2 million in 2021-22). This is mainly related to temporary fluctuations in the timing of payments to be issued to provinces and territories for the Disaster Financial Assistance Arrangements (DFAA) program.

Main Estimates 2021-22 - Vote 5 Grants & Contributions

The following tables presents the programs funded through Vote 5 – Grants and Contributions in 2021-22.

| Grants Listed in Main Estimates | 2021-22 Main Estimates |

|---|---|

| Memorial Grant Program for First Responders | 21,600,000 |

| Community Resilience Fund | 3,500,000 |

| Heavy Urban Search and Rescue Program | 3,100,000 |

| Other National Voluntary Organizations active in the criminal justice sector | 1,796,144 |

| Grants in support of the Safer Communities Initiative | 1,760,000 |

| Cyber Security Cooperation Program | 1,000,000 |

| Grants to provincial partners for the National Flagging System to identify and track high-risk violent offenders who jeopardize public safety | 1,000,000 |

| Total Grants | 33,756,144 |

| Contributions Listed in Main Estimates | 2021-22 Main Estimates |

| Disaster Financial Assistance Arrangements: Contributions to the provinces for assistance related to natural disasters | 445,750,181 |

| First Nations Policing Program: Payments to the provinces, territories, municipalities, Indian band councils and recognized authorities representing Indians on reserve, Indian communities on Crown land and Inuit communities, for the First Nations Policing Program | 172,070,209 |

| Gun and Gang Violence Action Fund | 61,286,023 |

|

42,582,899 |

| Contribution Program to Combat Serious and Organized Crime, which includes the following initiatives: | |

|

31,906,740 |

| Funding for First Nation and Inuit policing facilities | 18,247,326 |

| Contribution Program in support of the Search and Rescue New Initiatives Fund | 7,386,000 |

| Policy Development Contribution Program: Payments to the provinces, territories, and public and private bodies in support of activities complementary to those of the Department of Public Safety and Emergency Preparedness, , which include the following initiatives: | |

|

4,812,000 |

| Community Resilience Fund | 3,500,000 |

| Aboriginal Community Safety Development Contribution Program | 2,533,738 |

| Contribution Program to Combat Child Sexual Exploitation and Human Trafficking | 2,035,600 |

| Cyber Security Cooperation Program | 1,000,000 |

| Search and Rescue Volunteer Association of Canada Contribution Program | 714,000 |

| International Association of Fire Fighters, Canada | 500,000 |

| COSPAS-SARSAT Secretariat Contribution Program | 190,000 |

| Contribution in support of the Nation's Capital Extraordinary Policing Costs Program | 3,000,000 |

| National Disaster Mitigation Program | 20,000,000 |

| Biology Casework Analysis Contribution Program | 6,900,000 |

| Total Contributions | 824,414,716 |

| Total Grants and Contributions | 858,170,860 |

2021-22 Supplementary Estimates

In addition to Main Estimates funding, the Department has obtained additional funding through Supplementary Estimates A.

Vote 1 – Operating Expenditures

- Supplementary Estimates total $12.7 million in 2021-22 for:

- Funding to develop a buy-back program for assault-style firearms and a national social marketing campaign; and

- Funding for the Anti-Money Laundering Action, Coordination and Enforcement Team.

Vote 5 – Grants & Contributions

- Supplementary Estimates total $70.0 million in 2021-22 for:

- Funding to support the Canadian Red Cross’s urgent relief efforts (COVID-19); and

- Funding for the Safe Restart Agreement for federal investments in testing, contact tracing and data management (COVID-19) .

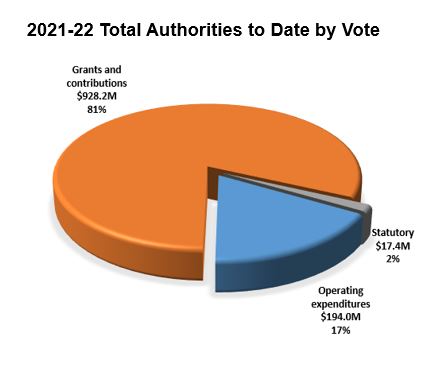

2021-22 Total Authorities to Date

Public Safety’s total authorities to date in 2021-22 are $1,139.6 million.

| Vote # | Vote Name | Main Estimates | Supplementary Estimates A | Authorities To-Date |

|---|---|---|---|---|

|

|

A | B | C = A+B |

| 1 | Operating expenditures |

181,272,861 | 12,719,168 | 193,992,029 |

| 5 | Grants and contributions |

858,170,860 | 70,000,000 | 928,170,860 |

| S | Contributions to employee benefit plans |

15,929,430 | 1,394,299 | 17,323,729 |

| S | Minister of Public Safety and Emergency Preparedness - Salary and motor car allowance | 90,500 | - | 90,500 |

| Total: | 1,055,463,651 | 84,113,467 | 1,139,577,118 |

Image Description

This graphic describes Public Safety’s total authorities to date for 2021-22, broken down per Vote and Statutory Authority, for a total amount of $1,139.6 million. Starting from the left-hand side and going clockwise, the “first” pie slice in the graph indicates that the department’s total Grants and Contributions authority amounts to $928.2M which represents 81% of the total authorities to date. Statutory authority accounts for 2% with $17.4 million as presented by the “second” slice. The “third” slice indicates that the Operating Expenditures authority accounts for 17% with $194.0 million.

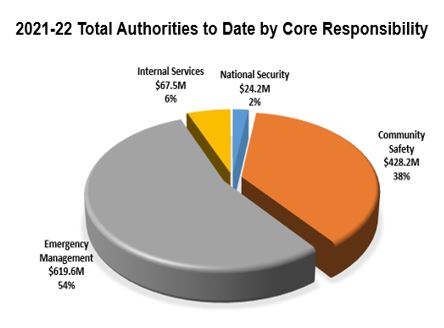

Image Description

This graphic describes Public Safety’s total authorities to date for 2021-22, broken down per Core Responsibility and Internal Services, for a total amount of $1,139.6 million. Starting from the left-hand side and going clockwise, the “first” pie slice in the graph indicates that Emergency Management accounts for 54% with an authority of $619.6 million. Internal Services accounts for 6% with $67.5 million as presented by the “second” slice. The “third” slice indicates that National Security accounts for 2% with $24.2 million. Community Safety accounts for 38% with $428.2 million, as shown by the “fourth” slice.

Sunsetter Funding - Ends in 2021-22

Funding for these programs will conclude on March 31, 2022, unless renewed by the government.

| Initiative Name | Grants & Contributions Program Name |

IVote 1 - Operating Expenditures | IVote 5 - Grants & Contributions | ITotal Funding | IDescription |

|---|---|---|---|---|---|

| Implementation of Canada's new legal framework to strictly regulate and restrict access to cannabis | N/A | 934,204 | - | 934,204 | The proposed Cannabis Act would create a strict legal framework for controlling the production, distribution, sale and possession of cannabis across Canada. |

| Addressing the needs of vulnerable offenders in the federal correctional system | Aboriginal Community Safety Development Contribution Program | 205,700 | 2,533,738 | 2,739,438 | Indigenous offenders continue to be disproportionately represented at all levels of the Canadian criminal justice system and the Indigenous Community Corrections Initiative (ICCI) was created to help close the gaps in service for Indigenous Peoples in the criminal justice system. |

| National Strategy for Protecting Children from Sexual Exploitation Online | Contribution Program to Combat Serious and Organized Crime | 2,044,573 | 6,600,000 | 8,644,573 | Online child sexual exploitation is one of the most disturbing public safety issues facing society today. Efforts under the National Strategy aim to raise awareness of this serious issue, reduce the stigma associated with reporting incidents, increase Canada’s ability to pursue and prosecute offenders, and collaborate with industry to find new ways to combat sexual exploitation of children online. |

| Initiatives to Enhance the National Security Framework | N/A | 1,313,592 | - | 1,313,592 | The funds are intended to implement the National Security Transparency Commitment across the Government’s national security and intelligence community and for the establishment of a Centre of Expertise in domestic national security information sharing under the Security of Canada Information Sharing Act (SCISA). |

| National Disaster Mitigation Program | National Disaster Mitigation Program | 947,728 | 20,000,000 | 20,947,728 | The National Disaster Mitigation Program (NDMP) aims to reduce the impacts of flood disasters on Canada by: 1) focusing investments on significant, recurring flood risks and costs; and 2) advancing work to expand the private residential insurance market for overland flooding. |

| Canada’s Flood Risk Plan | Payments to provinces, territories, and public and private bodies in support of activities complementary to those of the Department of Public Safety and Emergency Preparedness | 2,588,040 | 200,000 | 2,788,040 | The objective is to create an interdisciplinary Task Force to develop options for high risk residential flood insurance and for the potential relocation of Canadians at highest risk of recurrent flooding, also known as strategic relocation. |

| Supporting the Canadian Red Cross’s urgent relief efforts related to COVID-19, floods and wildfires | Supporting the Canadian Red Cross’s urgent relief efforts related to COVID-19, floods and wildfires | - | 70,000,000 | 70,000,000 | The funding will enable the Red Cross to support Canadians through a number of projects, including support to long-term care facilities, support health authorities’ efforts relative to vaccination campaigns and maintaining workforce capacity. The program will be replaced by the Humanitarian Workforce (HWF) Program. |

| Total | 8,033,837 | 99,333,738 | 107,367,575 |

Delegation of Financial Signing Authority

- The Delegation of Financial Signing Authority (DFSA) allows Ministers to delegate their financial authorities associated with the expenditure process to authorized positions within the Department.

- The DFSA sets strict limits on approval levels that are consistent with Treasury Board policy and ensures an appropriate segregation of duties within the payment process.

- In this manner, the DFSA defines clear accountabilities for the exercise of financial authorities while ensuring that management controls are appropriate to the level of risk.

- Departments are required to provide new Ministers with an updated DFSA for approval within 90 days of a transition.

- Until the new DFSA is approved, departmental officials will continue to exercise financial authorities that were conferred under the previous DFSA.

An Overview of Financial Administration in the Government

The following is to provide a brief overview of the financial administration in the government.

Funding for New Initiatives

- The Minister of Finance develops the budget with the support of the Department of Finance Canada, which analyzes the fiscal implications of budget proposals, in close consultation with the Prime Minister and the Privy Council Office. The federal budget reveals the government’s priorities, policies and plans.

- A funding decision can also be obtained through an off-cycle funding request to the Minister of Finance.

- A decision on a policy proposal is sought from the Cabinet through a Memorandum to Cabinet.

- The Treasury Board submission is then used to seek specific authorities or approvals from the Treasury Board to help implement a new initiative.

- The financial impact of the Treasury Board submission will be reflected in the Estimates process.

- Parliament authorizes government spending through the Estimates and the associated Appropriation Bills. This process is often called the business of supply.

- The Departmental reference levels (or financial authorities) are defined as the amount of funding Treasury Board (TB) approves to carry out the Department’s approved policies and programs

- An analysis of the reference levels is performed to maintain existing programs and services, and to incorporate adjustments to reflect increases or decreases to program funding levels approved by the Treasury Board. This process is called the Annual Reference Level Update, which is the basis for the development of the Main Estimates.

- The Main Estimates present the government’s appropriation needs for each federal organization, for a given fiscal year starting on April 1st. Parliament votes on interim supply (3/12th of budget for the fiscal year) and full supply (remaining 9/12th of budget).

- Given that the Main Estimates do not include the government’s complete spending needs for the year, such as unanticipated spending needs or items announced in the budget, the government also presents supplementary estimates to Parliament for review and approval. The government tends to present supplementary estimates in May, November and February, and each set of supplementary estimates receives an alphabetical designation – A, B or C.

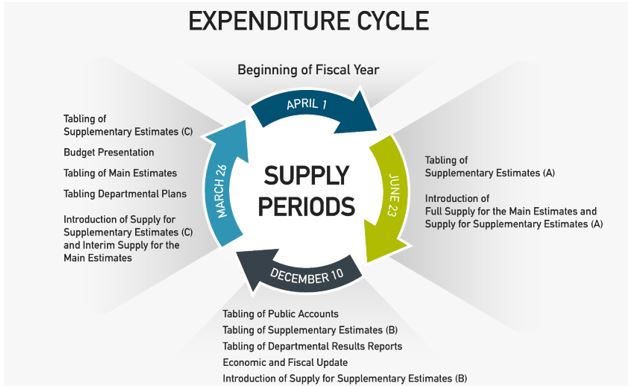

The Parliamentary Financial Cycle

- The fiscal year begins on April 1st and concludes on March 31st and follows a loop of activities divided into before, during, and after fiscal year sections as outlined below.

Image Description

EXPENDITURE CYCLE

Supply Periods

APRIL 1

- Beginning of fiscal year

JUNE 23

- Tabling of Supplementary Estimates (A)

- Introduction of Full Supply for Main Estimates and Supply for Supplementary Estimates (A)

DECEMBER 10

- Tabling of Public Accounts

- Tabling of Supplementary Estimates (B)

- Tabling of Departmental Results Reports

- Economic and Fiscal Update

- Introduction of Supply for Supplementary Estimates (B)

MARCH 26

- Tabling of Supplementary Estimates (C)

- Budget Presentation

- Tabling of Main Estimates

- Tabling of Departmental Plans

- Introduction of Supply for Supplementary Estimates (C) and Interim Supply for Main Estimates

Before the Fiscal Year

- In the fall, the House of Commons Standing Committee on Finance holds pre-budget consultations during which it seeks the views of Canadians on what recommendations it should make to the Minister of Finance for the government’s upcoming budget.

- In February or March, the Minister of Finance presents the government’s budget, which outlines the government’s taxation and spending priorities for the coming fiscal year.

- On or before March 1st the government tables its main estimates for the coming fiscal year. The main estimates are prepared in the late fall, and thus generally do not include spending items announced in the budget.

- Later in March, the government tables departmental plans. These plans set out the results that departments intend to achieve with the resources provided to them, and they outline the human and financial resources allocated to each program.

- Before the beginning of the fiscal year, the House of Commons approves interim supply. As full supply is not granted until June, the government needs authorization to spend funds during the first three months of the fiscal year. Thus, interim supply is usually three-twelfths of the amount outlined in the main estimates.

During the Fiscal Year

- To obtain approval for additional funding, the government submits supplementary estimates to Parliament. Generally the government submits three supplementary estimates during the fiscal year – in the spring, fall and winter – and each supplementary estimate is designated by a letter: supplementary estimates A, supplementary estimates B, and C.

- In the fall, the Minister of Finance presents an economic and fiscal update, which provides mid-year information on the country’s economic growth and the state of the government’s finances.

- Throughout the year, federal departments prepare and make public quarterly financial reports, which compare planned with actual expenditures.

After the Fiscal Year

- Sometime after the end of the fiscal year (usually in October), the government presents its public accounts, which outline the government’s actual spending during the year.

- Also in the fall, the government releases departmental results reports for each department and agency. These reports describe achievements relative to the expectations outlined in the corresponding departmental plans.

Minister’s Office budget

- Ministers’ Office (MO) budgets are subject to close governmental and parliamentary scrutiny. As a result, Treasury Board (TB) requires that “the expenditure of funds in [MO] budgets must be made only with the usual high standards of prudence and probity.” To ensure these standards are upheld, TB has put in place special rules for the management of both the exempt staff budget and the operating cost budget.

- Ministers are answerable to TB and personally accountable to Parliament for the expenditures of their office. MO budgets may not be exceeded and the Public Accounts provide annual detailed reporting of MO spending in addition to routine proactive disclosure. MO expenditures are part of the Department’s Vote 1 appropriation and as such the DM is the responsible accounting officer for them and they are subject to the Department’s internal audit function.

- Authority to initiate and approve expenditures may be delegated by the Minister to the Chief of Staff or other senior staff. The Department will prepare the necessary delegation instruments to reflect the Minister’s preferences regarding the individuals in the office who will manage the MO budget.

- Responsibility for hiring, pay, or termination of exempt staff falls to the Minister, and cannot be delegated. The Minister may configure staff complement as one sees fit within the prescribed budget, subject to TB rules and direction from the Prime Minister’s Office.

The Department’s Chief Financial Officer’s team would be pleased to provide you and your staff more detail about financial comptrollership including on delegations of financial authority, travel and hospitality management.

- Date modified: